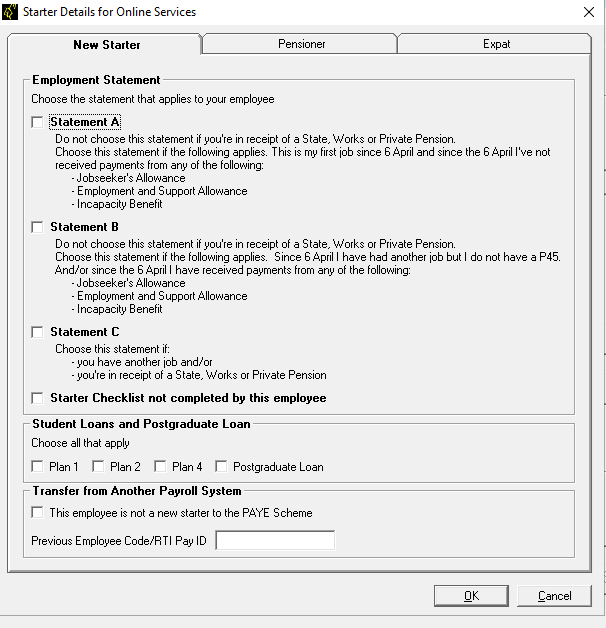

The annual thresholds have changed for 2021/2022:

Plan Type 1 increased from £19,390 to £19,895

Plan Type 2 increased from £26,575 to £27,295

Plan Type 4 is new for April 2021 and has a threshold of £25,000

Postgraduate Student Loans remains at £21,000.

Software changes

The annual thresholds have been updated in Capital Gold Payroll in line with legislation for 2021/2022:

Print Tax/NI/Pension Rates

We have updated File | Print Tax/NI/Pension to include the new threshold for Student Loan Plan Type 4.

Payroll Calculations

Although the threshold differs when calculating Student Loan Plan Type 4, there is no change to the rate or method when calculating student loan deduction.

Example - Plan Type 4 (using 2021/2022 monthly thresholds)

| Student Loan Plan Type | 4 |

| NIable Pay | 2,500 |

| Annual Threshold | 25,000 |

| Monthly Threshold | 2,083.33 |

| Deduction Rate | 9% |

| Student Loan Deduction | 2,500 – 2,083.33 * 9% = £37 (rounded down to nearest £) |

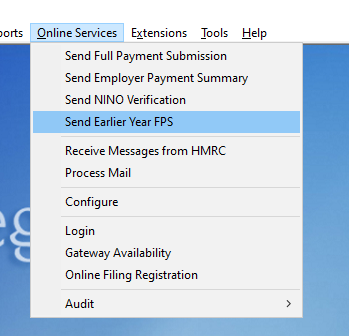

RTI

RTI submissions have been updated to include all Student Loan Plan Types. The FPS Student Loan Year to-date value will be a combination of Plan Type 1, 2 and 4 deductions where all, or either, have existed in the current year.

Applies to

Employees subject to student loan repayments.

Effective

From 6 April 2021.

More information

For further details about the student loan, visit https://www.gov.uk/browse/education/student-finance.