Cashbook Postings

Use the Processing command on the Cashbook

menu to post transactions for nominal, sales and purchase accounts and

to record transfers between bank and cash accounts. You use these commands

for transactions not otherwise generated from other modules (such as Sales

or Purchase modules). First retrieve the bank account you want to process,

then select the appropriate command from the Action

menu.

If the Continuous Posting option

is selected on the User Profiles form in the

System module for your user record, you can post movements of the same

type in batches because the application automatically reselects the same

command (N/L Posting, S/L

Posting, and so on) when you complete a transaction record.

Nominal Ledger Postings

Use the N/L Posting command to enter cashbook

postings for accounts in the nominal ledger. If the Real

Time Update of Nominal option is selected on the Options

tab of the Company Profiles form in the System

module, nominal accounts selected for processing are updated when you

accept the cashbook posting. Otherwise, if the batch updating method is

used, nominal accounts selected for processing are updated when you use

the Cashbook Transfer command on the Utilities

menu in the Nominal module.

N/L Posting Entries

Box |

Description |

Input By |

The name of the person maintaining the posting record.

The user name as defined on the User Profiles

form in the System module is used as a default entry. You

can select a different user name from the list. |

Type |

An option that determines the transaction type you want

to enter. You can select Payment

or Receipt from a list. |

Cashbook Type |

A reference that identifies the cashbook transaction

type. You can select from a list. Cashbook types are maintained

using the Cashbook Types command

on the Maintenance submenu in the

Cashbook module. |

Reference |

A reference for the transaction. |

Value |

The amount of the transaction in the currency of the

bank account. |

Exch Rate |

The exchange rate for the currency. This defaults to

the exchange rate defined on the System

Exchange Rates form. In the case of Euro triangulation,

exchange rates are calculated using special rules where more

than one Euro zone currency is involved in the transaction. |

Comment |

A memorandum or note concerning the nature of the transaction. |

Date |

The date for the transaction. The system date is displayed

but you can change if the transactions are for a different

date.

If you use the Open

Period Accounting feature, this is the date used to determine

the period in the Nominal Ledger that the transaction is posted

to. If the transaction is allocated to another transaction

that generates an adjustment posting for either a foreign

currency rate gain or loss or a discount, the adjustment also

uses the same Nominal Ledger posting date.

|

VAT |

An option that determines whether the transaction is

subject to VAT analysis. That is, whether it is included in

the VAT return. If you select the option, you can accept or

amend the default tax point date in the box alongside. In

some circumstances, a tax point date may be different to the

transaction date, but is always the date used to determine

in which VAT return period the transaction belongs. The default

is the current system date, but may also be affected by the

transaction date. |

Payment Details

Box |

Description |

Print Remit |

An option that determines whether a remittance advice is

to be printed for the nominal payment. |

Print Cheque |

An option that determines whether a cheque is to be printed

for the nominal payment. |

BACS |

An option that determines whether the nominal payment is

to be processed as a BACS payment by your bank using the banking

format selected in the BACS Software

list on the Cashbook

- Utilities - Set Options form or the Cashbook

- Utilities - Set Options - Additional BACS Options form.

This is available for home currency bank accounts,

and for Euro bank accounts if the Use

for SEPA Payments option is selected for the account. |

Payee |

A reference that identifies the payee.

Payee names are defined

using the Cashbook -

Maintenance - Payee Names form. Payee names are defined

using the Cashbook -

Maintenance - Payee Names form.

|

Bank Details |

The sort code, account number and bank reference for the

BACS transaction. If the Use

for SEPA Payments option is selected for the bank account

the BIC

and IBAN

boxes are enabled. BIC

and IBAN codes are

used for 'SEPA CT'

payment files instead of the sort code and account numbers. What's

SEPA?

The codes default to those entered on the payee name record

selected in the Payee list box. |

Credit Card Receipt Details

Box |

Description |

Credit Card Number |

The credit card number. This must be 13 digits long. |

Expires |

The month and year of expiry. This date is validated against

the transaction date. If a recurring entry is defined with credit

card details, the application will not post the entry if the expiry

date falls before the transaction posting date. |

Authorise No. |

An authorisation number, if required. This can include letters

as well as numbers if appropriate. |

Name |

The cardholder name as it appears on the credit card. |

Transaction Details

Box |

Description |

Account |

A reference that identifies the nominal account record.

You can select from a list. |

Value |

The value of the transaction detail. |

Advanced Nominal Dimensions |

References that identify the dimensions used for the analysis

of the current transaction line in the nominal ledger. If

you have the Advanced Nominal Ledger activation and you are using

either of the two additional analysis dimensions (such as Project

and Department), you can override the defaults shown for the current

transaction line; the defaults being those associated with the

corresponding nominal account record identified in the

Account box. If

the corresponding nominal account record indicates that the use

of one or both dimensions is mandatory, then you must ensure an

appropriate ID has been entered before you save the transaction

line. For further information, refer to the topic on advanced

nominal dimensions associated with the Nominal module. |

VAT Code and Value |

The VAT code for the transaction. This defaults to the code

specified on the account identified in the Account

box. It only applies if you have selected the VAT

option on the Nominal Postings form.

The amount of VAT is calculated according to the rate associated

with the code and the amount entered in the Value

box. You can override the default calculation. |

Comment |

A memorandum or note concerning the nature of the transaction.

This defaults to the entry on the Nominal Postings form. |

Sales Ledger Postings

Use the S/L Posting command on the Action

menu associated with the Bank Account form to

enter receipts and refunds for customer account records in the Sales module.

If more than one Sales module is linked to the Cashbook company, you must

select the company from which the sales accounts will be read for processing

before you can enter the posting. Before you can post payments or refunds

to supplier accounts, you must ensure that an entry exists in the Cashbook Type list box on the Sales

Receipt Names or Sales Refund Names forms.

Receipt and refund names are defined using the Receipt

Names or Refund Names commands on the

Utilities menu in the Sales module.

S/L Posting Entries

Box |

Description |

Posting Type |

An option that determines the transaction type you want

to enter. You can select Receipt or

Refund from a list. |

Input By |

The user name of the person entering the transaction. The

user name as defined on the User Profiles

form in the System module is used as a default entry. You can

select a different user name from the list. |

Customer |

The customer record relating to the receipt or refund. You

can select the record from the list. |

Balance |

The selected customer's current balance taken from the customer's

record. |

NL Posting Date |

The Nominal Ledger posting date. If you use the Open

Period Accounting feature, this is the date used to determine

the period in the Nominal Ledger that the transaction is posted

to. If the transaction is allocated to another transaction that

generates an adjustment posting for either a foreign currency

rate gain or loss or a discount, the adjustment also uses the

same Nominal Ledger posting date.

|

Transaction Date |

The transaction date. This is the date used to determine

the age of a transaction for reports and enquiries in the application.

The default is the system date. If the transaction is allocated

to another transaction that generates an adjustment posting for

either a foreign currency rate gain or loss or a discount, the

adjustment also uses the same Nominal Ledger posting date. |

Reference 1 |

A reference for the transaction. This is mandatory. Typically

you use this box for the main transaction reference. |

Reference 2 |

A second transaction reference. You select the second reference

from a list. The entries you can choose are defined in the Sales

Ledger on the Receipt Names form on

the Utilities menu. |

Currency |

A reference that identifies the currency of the receipt

or refund. This only applies to foreign currency bank accounts.

You can select the currency from a list. Currencies are defined

using the Exchange Rates form in the

System module and the default depends on the entry in the Currency list box on the Options

form associated with the Customer form. |

FC Value |

The foreign currency value of the receipt or refund. For

foreign currency bank accounts, you enter the transaction amount

in this box and the home currency equivalent is calculated according

to the exchange rate. |

Exch. Rate |

The exchange rate for the currency. This defaults to the

exchange rate defined on the System Exchange

Rates form. |

Transaction Value |

The transaction value. For foreign currency transactions,

the default entry in this box will be the home currency equivalent

of the value entered in the FC Value

box. |

Advance |

An option that determines whether the transaction belongs

to the following accounting period and only becomes a current

transaction after you use the End of Period

command. This only applies if the Allow

Advance Postings option is selected on the Sales

Set Options form. |

Overpay by... |

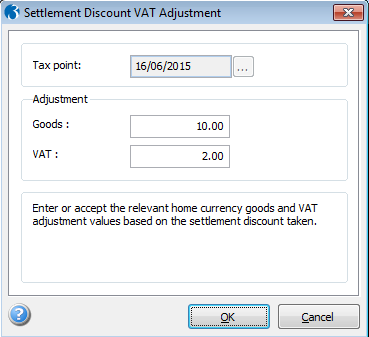

This applies only if the VAT Return Reduction

By option on the Sales

Ledger - Processing - Terms form is set to 'VAT Adjustment'.

The overpayment value for a payment where settlement discount

is being taken. The value entered here is used only for calculating

the adjustment goods and VAT reductions for you on the Settlement

Discount VAT Adjustment form. You must check these values

before posting the adjustment.

This is always entered in the home currency.

Example

...

|

Underpay

and clear invoices(s) |

This applies only if the VAT Return Reduction

By option on the Sales

Ledger - Processing - Terms form is set to 'VAT Adjustment'.

An option that determines that the transaction is an underpayment

but the invoice is being cleared. If this box is selected the

adjustment goods and VAT values cannot be calculated for you on

the Settlement

Discount VAT Adjustment form. You must calculate the goods

and VAT reductions before posting the adjustment. |

Refund Details

Box |

Description |

Print Remit |

An option that determines whether a remittance advice is

to be printed for the refund. |

Print Cheque |

An option that determines whether a cheque is to be printed

for the refund. |

BACS |

An option that determines whether the refund is to be processed

as a BACS payment by your bank using the banking format selected

in the BACS Software list on the Cashbook - Utilities

- Set Options form.

This is available for home currency bank accounts,

and for Euro bank accounts if the Use

for SEPA Payments option is selected for the account. |

Payee |

A reference that identifies the payee.

Payee names are defined

using the Cashbook -

Maintenance - Payee Names form. Payee names are defined

using the Cashbook -

Maintenance - Payee Names form.

|

Bank Details |

The sort code, account number and bank reference for the

BACS transaction. If the Use

for SEPA Payments option is selected for the bank account

the BIC

and IBAN

boxes are enabled. BIC

and IBAN codes are

used for 'SEPA CT'

payment files instead of the sort code and account numbers. What's

SEPA?

The codes default to those entered on the payee name record

selected in the Payee list box. |

Purchase Ledger Postings

Use the P/L Posting command on the Action

menu associated with the Bank Account form to

enter payments and refunds for supplier account records in the Purchase

module. If more than one Purchase module is linked to the Cashbook company,

you must select the company from which the sales accounts will be read

for processing before you can enter the posting. Before you can post payments

or refunds to supplier accounts, you must ensure that an entry exists

in the Cashbook Type list box on the Purchase

Payment Names or Purchase Refund Names

forms. Payment and refund names are defined using the Payment

Names or Refund Names commands on the

Utilities menu in the Purchase module.

P/L Posting Entries

Box |

Description |

Posting Type |

An option that determines the transaction type you want

to enter. You can select Payment or

Refund from a list. |

Input By |

The user name of the person entering the transaction. The

user name as defined on the User Profiles

form in the System module is used as a default entry. You can

select a different user name from the list. |

Customer |

The supplier record relating to the payment or refund. You

can select the record from the list. |

Balance |

The selected customer's current balance taken from the customer's

record. |

NL Posting Date |

The Nominal Ledger posting date. If you use the Open

Period Accounting feature, this is the date used to determine

the period in the Nominal Ledger that the transaction is posted

to. If the transaction is allocated to another transaction that

generates an adjustment posting for either a foreign currency

rate gain or loss or a discount, the adjustment also uses the

same Nominal Ledger posting date.

|

Transaction Date |

The transaction date. This is the date used to determine

the age of a transaction for reports and enquiries in the application.

The default is the system date. If the transaction is allocated

to another transaction that generates an adjustment posting for

either a foreign currency rate gain or loss or a discount, the

adjustment also uses the same Nominal Ledger posting date. |

Reference 1 |

A reference for the transaction. This is mandatory. Typically

you use this box for the main transaction reference. |

Reference 2 |

A second transaction reference. You select the second reference

from a list. The entries you can choose are defined in the Purchase

Ledger on the Payment Names form on

the Utilities menu. |

Currency |

A reference that identifies the currency of the payment

or refund. This only applies to foreign currency bank accounts.

You can select the currency from a list. Currencies are defined

using the Exchange Rates form in the

System module and the default depends on the entry in the Currency list box on the Options

form associated with the Customer form. |

FC Value |

The foreign currency value of the payment or refund. For

foreign currency bank accounts, you enter the transaction amount

in this box and the home currency equivalent is calculated according

to the exchange rate. |

Exch. Rate |

The exchange rate for the currency. This defaults to the

exchange rate defined on the System Exchange

Rates form. |

Transaction Value |

The transaction value. For foreign currency transactions,

the default entry in this box will be the home currency equivalent

of the value entered in the FC Value

box. |

Overpay by... |

This applies only if the VAT Return Reduction

By option on the Purchase

Ledger - Processing - Terms form is set to 'VAT Adjustment'.

The overpayment value for a payment where settlement discount

is being taken. The value entered here is used only for calculating

the adjustment goods and VAT reductions for you on the Settlement

Discount VAT Adjustment form. You must check these values

before posting the adjustment.

This is always entered in the home currency.

Example

...

|

Underpay and

clear invoices(s) |

This applies only if the VAT Return Reduction

By option on the Purchase

Ledger - Processing - Terms form is set to 'VAT Adjustment'.

An option that determines that the transaction is an underpayment

but the invoice is being cleared. If this box is selected the

adjustment goods and VAT values cannot be calculated for you on

the Settlement

Discount VAT Adjustment form. You must calculate the goods

and VAT reductions before posting the adjustment. |

Bank Transfers

Use the Bank Transfer command on the Action menu associated with the Bank

Account form to enter postings between one Cashbook account and

another or between a Cashbook account and a nominal account (for example

to make postings for bank charges).

Bank Transfer Entries (From)

Box |

Description |

Input By |

The name of the person maintaining the posting record.

The user name as defined on the User Profiles

form in the System module is used as a default entry. You

can select a different user name from the list. |

Cashbook Type |

A reference that identifies the cashbook transaction

type. You can select from a list. Cashbook types are maintained

using the Cashbook Types command

on the Maintenance submenu in the

Cashbook module. |

Reference |

A reference for the transaction. |

Value |

The amount of the transfer in the currency of the bank

account. |

Exch Rate |

The exchange rate for the currency. This defaults to

the exchange rate defined on the System

Exchange Rates form. In the case of Euro triangulation,

exchange rates are calculated using special rules where more

than one Euro zone currency is involved in the transaction. |

Comment |

A memorandum or note concerning the nature of the transaction. |

Date |

The date for the transaction. The system date is displayed

but you can change if the transactions are for a different

date.

If you use the Open

Period Accounting feature, this is the date used to determine

the period in the Nominal Ledger that the transaction is posted

to. If the transaction is allocated to another transaction

that generates an adjustment posting for either a foreign

currency rate gain or loss or a discount, the adjustment also

uses the same Nominal Ledger posting date.

|

Transaction Details

Box |

Description |

Account |

A reference that identifies the nominal account record.

You can select from a list. |

Value |

The value of the transaction detail. If you are processing

a transfer involving a foreign currency bank account, boxes

are also provided for the home currency equivalent and exchange

rate for the detail line. |

Advanced Nominal Dimensions |

References that identify the dimensions used for the

analysis of the current transaction line in the nominal ledger.

If you have the Advanced Nominal Ledger

and you are using either of the two additional analysis dimensions

(such as Project and Department), you can override the defaults

shown for the current transaction line; the defaults being

those associated with the corresponding nominal account record

identified in the Account

box. If the corresponding nominal account

record indicates that the use of one or both dimensions is

mandatory, then you must ensure an appropriate ID has been

entered before you save the transaction line. For further

information, refer to the topic on advanced nominal dimensions

associated with the Nominal module. |

Comment 1 |

A memorandum or note concerning the nature of the transaction.

This defaults to the entry on the Bank

Transfer (From) form. |

Accounting for Settlement Discount

VAT in the UK must be calculated before any prompt payment discount

(settlement discount) is calculated. Your VAT Return must be updated with

the full VAT value when an invoice is posted, even if settlement discount

is offered.

How do you make

sure VAT is calculated before prompt payment discount is calculated?

If the settlement discount is taken when an invoice is paid, an accounting

adjustment must be made which does the following:

The accounting adjustment can be posted using either a credit note or

a VAT adjustment after the receipt or payment is posted:

In the Purchase Ledger you

define on each supplier record how the adjustment will be posted.

In the Sales Ledger you can

define it either from the Sales

Ledger - Utilities - Set Options form, or on each customer record.

Important: Customers are set

to 'Company Default' for this purpose, so each customer uses the default

setting on the Sales

Ledger - Utilities - Set Options - Settlement Discount Options form.

Suppliers are set to 'Credit Note' by default for this purpose. You may

need to change them if necessary.

For customers or suppliers who are set up to account for the adjustment

for settlement discount using a VAT Return adjustment posting, you enter

the adjustment details on the Settlement

Discount VAT Adjustment form, which is displayed after posting

the receipt or payment. Show

...

Sales example

- VAT Return adjustments - using credit notes

Sales example

- VAT Return adjustments - using VAT adjustments

Payee names are defined

using the Cashbook -

Maintenance - Payee Names form.

Payee names are defined

using the Cashbook -

Maintenance - Payee Names form.