Issue

Solution

Benefit

VAT values from another system could not be imported into Opera 3 before being submitted to HMRC.

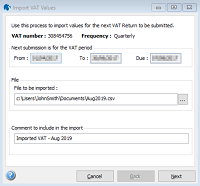

A wizard called 'Import VAT Values' is now available from the MTD VAT Centre to import VAT Return values from a comma separated values (CSV) file.

This is part of the 'Advanced MTD' chargeable feature.

This further extends the MTD features available so that Opera 3 can be used as bridging software between another accounting solution and HMRC.

Responses from HMRC after a VAT Return is submitted are not displayed in Opera 3.

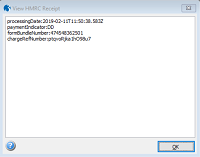

A view named 'View HMRC Receipt' is now available from the MTD VAT Centre.

This read-only view displays the detailed response from HMRC when a VAT Return has been received.

This view provides the assurance that VAT Returns have been received successfully by HMRC. The details can also be provided to HMRC if queries are raised.

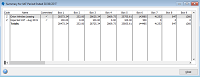

The Consolidation Summary view was previously used for consolidated companies only.

The view has been renamed as the 'Summary' view.

The view is now also used for stand-alone companies and consolidated companies.

The method to print a VAT Return for filing was not obvious.

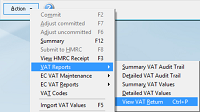

A new menu item called ‘View VAT Return’ is now available on the VAT Reports menu in the MTD VAT Centre.

This provides a visual alternative to the existing CTRL+P shortcut.

The message shown during a data backup or restore when all linked companies are not selected needed to be improved.

This message is now displayed if all linked companies are not selected for a data backup or restore:

There are companies linked together that you have not selected from the list. We recommend that all linked companies are backed up/restored together.

This message clarifies the recommendation that all linked companies are backed up or restored together.

When the transactions were copied into Microsoft Excel from the Transactions grid of the Nominal Ledger View, the Debit and Credit values could not be totalled.

The values are now copied into Microsoft Excel as positive and negative values rather than Debits and Credits.

The values are treated as any other values in Excel so they can be totalled and included in other calculations as required.

The Balance and Budget values in the History view were displayed as positive or negative values but the Transactions view uses debits or credits.

Both current period and year-to-date Balance and Budget values in the History view are now displayed as debits and credits. When a balance or budget is a positive value, it is displayed with ‘Dr’. When a balance or budget value is a negative value, it is displayed with ‘Cr’.

Both the History view and Transactions view present values in the same way. Also, it is easier to understand whether a value is over or under budget for all types of account.