To Complete a Payroll Period

This is a suggested sequence of tasks to update your payroll for each

pay period. If you are running the Payroll for the first time in the tax

year, or if changes to statutory rates have been announced, you must check

that the statutory rates are correct, for example tax rates. These rates

are displayed on the PAYE/NI/Stat.

Payments form.

Important: A number of actions

must normally be completed before the update is run, the list depends

on the features in use and the other applications in Opera that Payroll

is linked to. The Update form in Opera

3 displays a list of these actions and shows you whether they have been

run or not. You should complete any actions that have not been ticked

before running the update.

If you use payroll groups, you must update one group at a time.

If Payroll is integrated with the Costing application,

use the Payroll Transfer command

in Costing to transfer timesheet information for the current pay period.

On the Pay and Deductions

form on the Processing form, enter any necessary

changes to employee's payment and deduction information for the period.

Run the Calculation command.

You should not make any changes to employee's records after running

the calculation. The application produces a report that highlights

'exceptions', for example leavers in the period and tax overrides.

The report also lists anomalies, for example, if a payment that is

designed to reduce a balance cannot be made because the balance is

insufficient.

From the Payment Reports

menu:

Print payslips

Print cheques

Create BACS payments.

Then print any necessary reports from the Summary

Reports and Periodical Reports menus.

Carry out the Nominal Analysis

and Cashbook Transfer command on the Utilities menu if Payroll is linked to the Nominal

Ledger and Cashbook.

Backup your company data using the Backup

command on the Utilities menu in the System

application. For help on how to backup your data, refer to the Backup Help topic.

Create and submit the Full Payment Submission

for the period.

Run the Update command on

the Utilities menu to complete the current

pay period ready to start the next pay period.

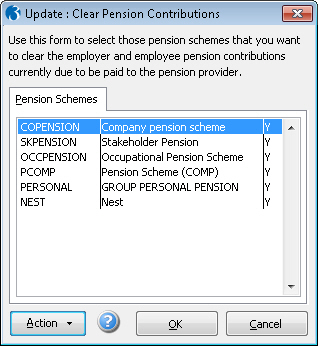

On the Pension Schemes form, select the schemes

only if you need to clear the contributions currently due to the pension

provider. This value is shown for each employee on the pensions

reports in Opera. Show

...

Important

- NEST pensions: You

must clear contributions

currently due if you have created the contribution file for NEST in this pay period using the Payroll

- Pensions Reports - Contribution File command. Contributions held

on to will not be cleared.

If you have not created the contribution file for the pension scheme do not select the pension

scheme from the list.