Cash Invoices

You can create cash invoices for which a receipt is posted at the same

time. A cash account is recognised by the prefix defined in the Cash Account Prefix box on the Set

Options form. For example, you might use the prefix 'CASH' and

so any account with a reference beginning with the word 'CASH' will be

treated as a cash sales account. The entry of the receipt details is done

when you have completed and posted the invoice details. When you have

completed the details, the relevant files are updated and the receipt

is automatically allocated to the invoice. The Post

Cash Receipt form appears and the following details are displayed

or required:

Box

| Description

|

Bank Account |

A reference that identifies the bank account to which

the receipt is posted. You can select from a list if the Multiple Bank Accounts option is selected

on the Sales Options form in the

Sales module. |

NL Posting Date |

The Nominal Ledger posting date. If you use the Open

Period Accounting feature, this is the date used to determine the

period in the Nominal Ledger that the transaction is posted to. For more

information, see the SOP/Invoicing

and Open Period Accounting Help topic.

|

Transaction Date |

The date of the invoice. |

Ref 1 |

The invoice number. |

Ref 2 |

This defaults to the receipt name specified for the

customer (this is the one selected using the Receipt

list box under Second Reference

on the Options form associated with

the Customer form in the Sales module),

or, if this is blank the first receipt description on the

Receipt Names form in the Sales

module. You can select an

alternative from a list. If you are using the Cashbook module,

this also determines the cashbook type. |

Transaction Value |

The receipt value (the amount being paid) which defaults

to the invoice value but can be amended to any value less

than that of the invoice. |

Reference |

You may enter a reference for the receipt in this field. |

Invoice Value |

The value of the invoice. |

Cashbook Paying In Slip Report

To include the cash receipt on the Paying

In Slip report in the Cashbook, make sure the Paying In Slip box is

ticked on the CashBook

Type used for the transaction. This does not apply to Credit Card

receipts.

Credit Card Details

If you have the Cashbook module and you have selected a receipt name

in the Ref 2 list for which the corresponding

Cashbook type is for credit cards, the Credit Card

Details form appears for entry of the credit card number, expiry

date and name on the card.

Credit Card Entries

Box

| Description

|

Card Number |

The credit card number. This must be 13 digits long. |

Expiry Date |

The month and year of expiry. |

Authorisation Number |

An authorisation number, if required. This can include

letters as well as numbers if appropriate. |

Name |

The cardholder name as it appears on the credit card. |

VAT Return Adjustments for Settlement Discount

VAT in the UK must be calculated before any prompt payment discount

(settlement discount) is calculated. Your VAT Return must be updated with

the full VAT value when an invoice is posted, even if settlement discount

is offered.

How do you make

sure VAT is calculated before prompt payment discount is calculated?

If the settlement discount is taken when an invoice is paid, an accounting

adjustment must be made which does the following:

The accounting adjustment can be posted using either a credit note or

a VAT adjustment after the receipt or payment is posted:

In the Purchase Ledger you

define on each supplier record how the adjustment will be posted.

In the Sales Ledger you can

define it either from the Sales

Ledger - Utilities - Set Options form, or on each customer record.

Important: Customers are set

to 'Company Default' for this purpose, so each customer uses the default

setting on the Sales

Ledger - Utilities - Set Options - Settlement Discount Options form.

Suppliers are set to 'Credit Note' by default for this purpose. You may

need to change them if necessary.

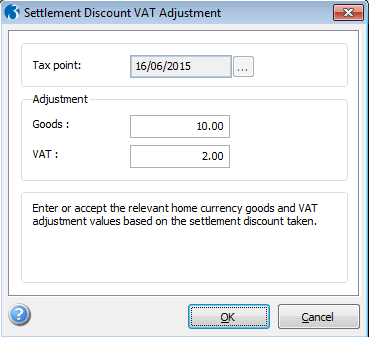

For customers or suppliers who are set up to account for the adjustment

for settlement discount using a VAT Return adjustment posting, you enter

the adjustment details on the Settlement

Discount VAT Adjustment form, which is displayed after posting

the receipt or payment. Show

...