Box

Description

An option that determines whether you want to specify a special set of trading terms for the customer. You must select this option if you want to enter certain details directly in boxes on the Trading Terms form. If the option is cleared, you must select an existing terms profile record in the Terms Profile list to determine the content of some of the boxes. Terms profiles are maintained using the Terms Profile command on the Maintenance submenu.

Terms Profile

A reference that identifies the terms profile you want to assign to the customer record. You can select from a list. Terms profiles are maintained using the Terms Profile command on the Maintenance submenu. You cannot select a profile if the Use Custom Profile? option is selected.

Discount Group

A reference that identifies a discount table created using the Discounts command in the Invoicing or SOP application. This only applies if you have the Invoicing or SOP application installed and activated. A discount table can relate either to a particular customer or to a group of customers who receive similar discounting terms. If this customer belongs to such a group, you can identify which discount group code applies. Note that if you leave this blank and you create a table with a blank group code, the discounts from that table will apply to this customer.

Discount tables are referenced by a two-part code. The first part of the code comprises either the customer's account code to make the table exclusive to that customer, or by a customer discount group code if the discounts apply to several customers. The second part of the code comprises a product group code which can be associated with product or stock items.

Discount tables can be set up with either a customer/customer group and a product group or a product group only. When customers belonging to a customer discount group order products that belong to the relevant product discount group, the discount from the table is applied as line discount. If no customer/customer group is specified on the discount table, all customers will receive the line discount when ordering products in the product group.

A reference that identifies a price list for a specific customer. This only applies if you use the Invoicing or SOP application. You can define Special Price lists in the Special Prices command in Invoicing or Sales Order Processing. Price list records can include 'next' and 'special' prices and options to include line, invoice and settlement discounts which override the settings on the stock file.

Invoice Discount

An overall percentage discount for each invoice. You can use up to two decimal places. This only applies if you have the Invoicing or SOP application installed and activated. The discount you specify here applies to all invoices created for this customer and is deducted after all line discounts have been taken. As VAT is calculated line by line, this discount may be subject to minor variances from the actual invoice total.

Due Date Options

An option that determines how the due date of a sales invoice is calculated.

You can select from a list one of the following options:

a number of days from the date of the invoice

a specific day in the month following the invoice date

a specific day two months from the invoice date.

Having selected the option from the list, enter the corresponding number of days or the day number in the Day(s) box to the right of the Due Date Options list.

Example: If you want the due date to be set to the last day of the following month, select 'Day of Month Following Invoice' and '31' days. This last day of the following month will then always be suggested in the Sales Ledger, Invoicing and Sales Order Processing applications.

Settlement Discount

The number of days that determines the period within which a customer is entitled to receive a discount on the invoice amount. You can specify two levels of discount according to two different periods. In the boxes alongside, type the percentage of discount applicable to the corresponding number of days. The second rate and period must not be more favourable than the first.

Click here to see a flowchart of the checks that are made to decide whether settlement discount should be included on an invoice.

Include Delivery Charges

An option that determines whether settlement discount is allowed on delivery charges or not. This only applies if you use the Invoicing or SOP application.

Important: Opera uses VAT code 'Y' for delivery charges and so this option applies only to lines analysed to code 'Y'.

VAT Inclusive

An option that determines whether the value of goods on sales invoice and credit note transactions includes VAT. If the option is selected, VAT is calculated on the assumption that the amount entered in the Goods Value box is the gross amount. The VAT portion of this is displayed in the VAT Amount box on the Analyse Customer Invoice form. If the option is cleared, VAT is calculated on the assumption that the amount entered in the Goods Value box is the net amount. The option applies to invoice and credit note transactions entered using the Processing command in the Sales application.

An option for customers who you offer settlement discount to. When settlement discount is taken the VAT Return must be updated to account for the reduction in the goods and VAT values.

Set to one of the following:

'Company Default' to set the customer to inherit the Sales Ledger-wide setting from the Sales Ledger - Utilities - Set Options - Settlement Discount Options form.

'Credit Note' to account for the VAT adjustment by posting a credit note for the customer. In this situation receipts involving settlement discount must be posted on account and then allocated to the invoice and credit note.

'VAT Adjustment' to account for the VAT adjustment using an adjustment posting directly after the receipt is posted.

What controls how Opera calculates VAT on invoices with prompt payment discount?

This option is disabled if either:

1. If you use the EC VAT application, the VAT

After Discount (Settlement) box on the EC

VAT - Maintenance - Countries form is selected.

2. If you don't use the EC VAT application, the VAT

calculated before settlement discount from date on the

System

- Maintenance - Company Profiles form is empty.

VAT Code (for foreign customers)

An option for customers who you offer settlement discount to. This relates to foreign customers only if the VAT Return Reduction By option is set to 'VAT Adjustment'. For foreign customers you must select the VAT code to use for VAT Return adjustments.

This option is enabled for foreign customers if VAT Adjustments rather than credit notes are used for VAT Return adjustments.

Banking

The banking details boxes are disabled until a bank account number is entered. If you use the Cashbook application (from where you can create bank payments files for transmission to your bank), these bank codes are included in a BACS file for refunds posted from the Sales Ledger - Processing form.

Bank Account

The customer's bank account number.

Sort Code

The customer's bank sort code. These codes should be 6 digits long.

Bank Ref.

A bank or building society reference allocated to the customer. This additional information may be required by certain banks or building societies. For example, payments made using National Westminster Bank's Autopay facility require a four-digit payee reference to be included in the payments file.

BIC

The Bank Identifier Code. If you enter one you must also enter the IBAN code. Both codes will be checked by Opera when you save your changes to ensure that they are entered in a valid format.

BIC and IBAN codes must be included for Single Euro Payments Area (SEPA) Euro payments.

IBAN

The International Bank Account Number. If you enter one you must also enter the BIC code. Both codes will be checked by Opera when you save your changes to ensure that they are entered in a valid format.

BIC and IBAN codes must be included for Single Euro Payments Area (SEPA) Euro payments.

Bank Identifier Codes (BICs) and International Bank Account

Numbers (IBANs) are used to identify banks across national borders. The

structure and length of the codes are defined by the International Organization

for Standardisation (ISO) so must be entered accurately. The length of

these codes can vary:

- BICs: minimum length 8 characters, maximum length 11 characters

- IBANs: minimum length 5 characters, maximum length 34 characters.

SEPA Payee

The name of the payee (up to 70 characters) that is included in a 'SEPA CT' payment file created using the Cashbook - Reports - BACS List report. This box is enabled if your licence includes the SEPA feature.

Only enter a SEPA payee name if the customer's name is longer than 30 characters and this customer will be refunded in a 'SEPA CT' payment file. If the SEPA Payee box is empty the customer's name entered on the Sales Ledger - Processing form will be used in the 'SEPA CT' payment file.

These options control whether a chosen document can be sent to the customer by email. For statements, proforma invoices and invoices the account contact's email address on the Sales Ledger - Processing form must already have been entered. For quotations, sales orders and delivery notes the order contact's email address must have been entered. These boxes are otherwise disabled.

For

instructions to set up customers for email and the rules that

Opera uses, see the To

Set Up Customers for Email Help topic.

For

instructions to set up customers for email and the rules that

Opera uses, see the To

Set Up Customers for Email Help topic.

An option that determines whether account statements are to be emailed to the customer as a default output option, rather than printing 'hard copies'. With this option selected, when you choose the Statement command on the Action menu associated with the Account View form, the Email tab is the default selection on the Publisher form. The e-mail address used for sending the statement is the one entered in the E-Mail Address box beneath the A/C Contact box on the General tab of the Customer form.

The statement itself is sent as a PDF attachment to the mail message. The PDF file name is customer account code appended by the day and month numbers (DDMM). The subject line of the e-mail message will default to 'Statement as at dd/mm/yy', where dd/mm/yy is the system processing date used for the application. Options are also available for the e-mailing of statements on the Statement Reports form displayed when you use the Statements command on the Reports submenu of the Sales application.

An option that determines whether sales quotations are emailed to the customer by default when they created using the Batch Processing command in the Invoicing or Sales Order Processing applications. The quotations are sent to the orders contact's email address as PDF attachments. The subject and the message text is picked up from the E-Mail Profile for sales quotations, which is defined in the System Manager.

If this option is not ticked, quotations can still be emailed but it is not the default option. Email profiles for sales quotations will also not be used.

An option that determines whether sales proformas are emailed to the customer by default when they are created using the Batch Processing command in the Invoicing or Sales Order Processing applications. The proformas are sent to the account contact's email address as PDF attachments. The subject line and the message text is picked up from the E-Mail Profile for sales proformas, which is defined in the System Manager.

If this option is not ticked, proformas can still be emailed but it is not the default option. Email profiles for sales proformas will also not be used.

An option that determines whether order acknowledgements are emailed to the customer by default when they are created using the Processing or Batch Processing command in the Invoicing or Sales Order Processing applications. The orders are sent to the order contact's email address as PDF attachments. The subject line and the message text is picked up from the E-Mail Profile for sales orders, which is defined in the System Manager.

If this option is not ticked, sales orders can

still be emailed but it is not the default option. Email profiles

for sales proformas will also not be used.

Order acknowledgements can be generated only if the Acknowledgement

Required option is selected on the Delivery

Details form for the customer.

An option that determines whether delivery notes are emailed to the customer by default when they are created using the Batch Processing command in the Invoicing or Sales Order Processing applications. The proformas are sent to the order contact's email address as PDF attachments. The subject line and the message text is picked up from the E-Mail Profile for delivery notes, which is defined in the System Manager.

If this option is not ticked, delivery notes can still be emailed but it is not the default option. Email profiles for delivery notes will also not be used.

An option that determines whether invoices are emailed to the customer by default when they are created in the Invoicing or Sales Order Processing applications. The invoices are sent to the account contact's email address as PDF attachments. The subject line and the message text is picked up from the E-Mail Profile for invoices, which is defined in the System Manager.

If this option is not ticked, invoices can still be emailed but it is not the default option. Email profiles for invoices will also not be used.

An option that determines whether credit notes are emailed to the customer by default when they are created in the Invoicing or Sales Order Processing applications. The credit notes are sent to the account contact's email address as PDF attachments. The subject line and the message text is picked up from the E-Mail Profile for credit notes, which is defined in the System Manager.

If this option is not ticked, credit notes can still be emailed but it is not the default option. Email profiles for credit notes will also not be used.

On stop or dormant accounts

Stop

An option that determines whether the customer account is on stop. If this option is selected, no accounting transactions except adjustments can be posted in either the Sales, Invoicing or SOP applications. You will still be able to carry out allocation procedures in the Sales application and you are given the option to create documents, quotations, pro forma invoices and sales orders in the SOP or Invoicing applications. However such documents cannot be progressed to delivery or invoice stage until the Stop option is cleared.

Putting an account on stop or clearing an account already on stop will create a note record for the customer.

An option that determines whether the customer record is in use. For customers you no longer trade with or whose records are otherwise inactive, you can mark them as 'dormant'. The customer record details remain, but the account cannot be the subject of transactions and is excluded from most other processes. For example, no new transactions can be created involving the customer in any application, and SOP documents for 'dormant' customers cannot be progressed.

When a customer record is marked as 'dormant', it is also excluded from most reports except those that provide an option to include 'dormant' customers specifically (such as the list of accounts, contacts report, and so on). You can also prevent 'dormant' customers from being shown in searches by clearing the Include Dormant Customers option on the Search form displayed when you use the Search for records matching criteria toolbar button. The default setting for this option is controlled by the Include Dormant Customers option on the Sales Ledger - Utilities - Set Options form.

You can tick the Dormant box for the customer if:

The current balance and the order balance are zero

The account is not linked to another account

The account does not have any recurring entries in the Cashbook

The account does not have any deliveries in the Sales Order Processing or Invoicing applications.

If you want to reinstate an inactive customer record, simply clear

the Dormant option.

If you want to reinstate an inactive customer record, simply clear

the Dormant option.

Debtors Letter/Correspondence

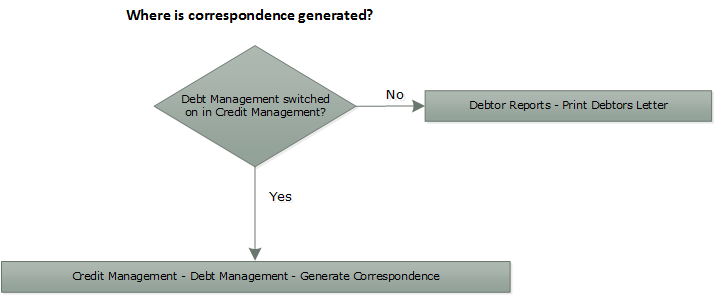

An option that determines whether debt correspondence is generated for the customer. You can use debtor letters as part of your credit control procedures to remind the customer of overdue transactions. If the Use Debt Management option in the Opera 3 Credit Management Centre is selected, debt management correspondence is designed and sent from the Credit Management Centre. If the option is not selected, debt management letters are designed and sent using the Print Debtor Letter from on the Reports menu.

Minimum Debt

This only applies if the Debtors Letter/Correspondence option is selected. Letters are only produced for outstanding values equal to or greater than the value you enter in this box.

An option that determines that debt correspondence is sent by email to the customer rather than printed.

The value of the credit limit for this customer. You are warned if the current balance on the account plus any transactions you are processing exceeds the credit limit. You can then decide whether to abandon the transaction or continue regardless. A credit limit of zero means no limit.

A default credit limit to be used for all new customers can be created on the Sales Ledger - Utilities - Set Options form.

Credit limits for one or more customers can also be entered at the same time in Credit Management Centre.

If

you do not allow a customer a credit limit, enter '1' in this

box.

If

you do not allow a customer a credit limit, enter '1' in this

box.

Reviewed On

The date the credit limit was last reviewed for this customer. This date is optional. This date can be set for one or more customers at the same time in Credit Management Centre.

CM Group

The allocated Credit Management Group for this customer. The group can be set for one or more customers at the same time in Credit Management Centre.

Groups are used to group customers so they can be filtered in Credit Management Centre. These codes are optional; you do not have to use groups in Credit Management Centre. Even if groups are created, you do not have to use one for each customer. You can allocate a group to some customers and not to others.

You can group your customers for Credit Management purposes in any number of ways. For example you could group them according to whether they normally pay their invoices on time or are late payers, according to sales turnover for the year and therefore the importance of the customer to your business, according to the geographical location of the customers and so on.