Box

Description

Analysis

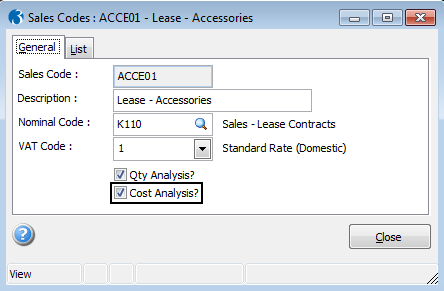

For sales invoices and credit notes, a reference that identifies the sales code record. For purchase invoices and credit notes, a reference that identifies the supply code record. You can select from a list. Sales codes are maintained using the Sales Codes command on the Maintenance submenu of the Sales application. They determine the nominal and default VAT codes to which the detail line is analysed.

Advanced Nominal Dimensions

References that identify the dimensions used for the analysis of the current transaction line. You can override the defaults shown for the current transaction line. If the nominal account associated with the supply or sales code entered in the Analysis box is set up to use one or both additional dimensions, default dimension IDs will appear in these boxes, otherwise they will be unavailable. The defaults will be those associated with the customer record or, if not there, then on the nominal account record linked to the sales analysis or supply code. If the corresponding nominal account record indicates that the use of one or both dimensions is mandatory, then you must ensure an appropriate ID has been entered before you save the transaction line.

Quantity

The quantity of goods associated with the detail line. For sales invoices and credit notes, the Qty Analysis option on the sales code record determines whether this information is required for sales analysis reporting. If the option is not selected, this box is unavailable.

Cost Centre

The cost centre to which the detail line is analysed. You can select from a list.

Goods Value

The net goods value of the detail line. As you complete each line, the value entered here updates the Total Goods box and reduces the value in the To Analyse box.

VAT Code

The VAT code for the detail line. The default displayed will be the VAT code associated with the analysis code unless the account relates to a customer or supplier in another EU member state in which case no default is supplied. You can select the appropriate code from a list.

Reverse Charge for Goods

You can select a Sales Reverse Charge for goods VAT code if the account is for a domestic customer and the RC Sales List option is selected on the Company Profiles form in the System Manager. What's Reverse Charge Accounting for goods?

Reverse Charge for Services

To account for a service provided to an EC customer that falls under the Reverse Charge provisions, use a zero rate VAT code which has been set up to update box 6 on the VAT Return and also update the EC Sales List. What's Reverse Charge Accounting for services?

VAT Amount

The VAT amount for the detail line. The default calculation is based on the rate associated with the VAT code record, the value entered in the Goods Value box and whether the VAT Inclusive option is selected on the Trading Terms form associated with the Customer form. As you complete each line, the value shown here updates the Total VAT box.

Cost

The cost of goods associated with the detail line. This is always a home currency value, even for foreign currency transactions.

For sales invoices and credit notes, the Cost Analysis option on the selected sales code determines whether this information is required for sales analysis reporting. If the option is not selected, this box is unavailable. Show ...

To Analyse

The value of the invoice that remains to be analysed. When this is zero you can post the transaction.

Total Goods

A running total of the goods values for all detail lines.

Total VAT

A running total of the VAT values for all detail lines.