Box

Description

File to be imported

The CSV import file to be imported.

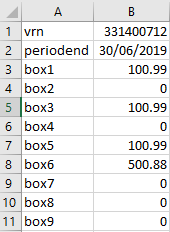

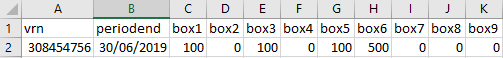

The import supports a file saved in both columns or rows format.

The column or row descriptions must be included in the file as follows.

vrn, periodend, box1, box2, box3, box4, box5, box6, box7, box8, box9.

Total boxes 3 and 5 are optional. They are re-calculated in Opera 3 after the import.

The default path for the import file is the Windows 'Documents' folder for the user (for example; 'c:\Users\JohnSmith\Documents').

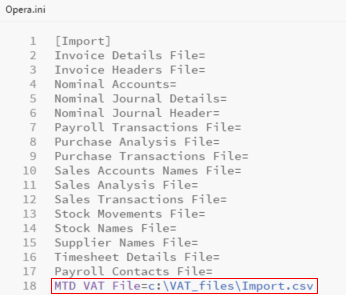

You can change the default path and import file name by updating the 'Opera.ini' file on your computer.

Changing the default path and import file name

To change the default location and file to 'c:\VAT_files\Import.csv', add the following line to the Opera.ini file under the [Import] heading:

MTD VAT File=c:\VAT_files\Import.csv

Changing the default path only

To change the default location only to 'c:\VAT_files\', add the following line to the Opera.ini file under the [Import] heading:

The 'Opera.ini' file is in the 'O3 Client XXX' folder below the ProgramData folder, where XXX identifies the Opera 3 edition being used. For example; 'c:\ProgramData\Pegasus\O3 Client VFP' or 'c:\ProgramData\Pegasus\O3 Client SE'.

After the file is imported

After the file is imported, it is renamed with a file name extension of '.BAK' and includes the following details:

VAT Registration Number

Date

Time.

For example; if the import was completed for a company with the VAT Registration Number '987654321' at 18:26:58 on 09/07/2019, the file 'Import.csv' is renamed to 'IMPORT.987654321.20190709.182658.BAK'.

Comment

You must also enter a comment to identify the import. This is displayed in the Summary view to identify the import.

If subsidiary companies are not currently maintained, before importing

VAT values for the first time you could create a separate company in Pegasus Opera 3 with the same VAT Registration

Number as your Opera 3 company and import the file into that company.

You will then be able to see those values independently of the group company.

When the file is imported from a subsidiary company the VAT Values will

be shown in both the subsidiary company and the group company.

If subsidiary companies are not currently maintained, before importing

VAT values for the first time you could create a separate company in Pegasus Opera 3 with the same VAT Registration

Number as your Opera 3 company and import the file into that company.

You will then be able to see those values independently of the group company.

When the file is imported from a subsidiary company the VAT Values will

be shown in both the subsidiary company and the group company.