[VFP] This module is not available in the SQL Server edition of the application.

The Fixed Assets module allows you to keep a complete register of assets, from their initial acquisition through to disposal. There are four depreciation methods that can be calculated by the system. Depreciation is deducted until the asset's residual value is reached. Depreciation and disposal details to-date can be recorded for assets acquired in previous periods or years. The system can record details of any Finance or Operating Lease and HP/Lease Purchase assets as well as company owned assets. For assets that do not fall into any of these categories, you can use another type called ‘Other’. Changes in expected life, depreciation rate or method and revaluations are all possible. These can be backdated to the start of the asset’s life.

The Fixed Assets module is structured into the following sections:

Section |

Description |

|---|---|

Processing |

This section is the main form in Fixed Assets. Use the form to create and maintain asset records, post opening balance, overrides, revaluations, and disposals, and renumber and transfer assets. You can also view transaction details for each asset from this form. |

Reports |

This section provides listings of records maintained on the various forms in the Fixed Assets module and transactions generated as a result of opening balances, overrides, revaluations, transfers, renumbering and disposals. Reports can be used to view information on your screen as well as printing. Most reports provide a number of options to determine the criteria, sequence and range of records reported. |

Utilities |

This section is where you choose the settings for the Fixed Assets module. You can also create the codes for your assets' balance sheet groups and disposal types. This is also where you calculate each period's depreciation, update the Nominal Ledger, post adjustments to the previous year and update the insurance value of your assets. An import command is also available. |

Maintenance |

This section is where you define your Fixed Assets category groups and asset categories, location codes and insurance company codes. |

Note: Fixed Assets can be used

as a standalone module or it can be used together with the Nominal Ledge.

- If you use another software product's General Ledger, use the Nominal

Journal report to manually update your Nominal Ledger.

- If you use the Nominal Ledger, make sure the Fixed

Assets to Nominal option on the System

- Maintenance - Company Profiles form is ticked to link the modules.

Each asset has a status that changes after amendments are made to the asset and it moves through its life. Many of the reports in Fixed Assets allow you to filter assets by their status.

Status |

Description |

|---|---|

The asset has been added to Fixed Assets but has not yet been depreciated. |

|

The asset has been depreciated either in this period or in an earlier period. |

|

The asset has been disposed and will not be depreciated any more. |

|

The asset has been depreciated and has reached its residual value. |

|

The asset reference has been changed to a new reference. All transactions for the asset are moved to the new asset reference. |

|

The asset has been created in the Purchase Ledger or Purchase Order Processing and has not been allocated to a location or cost centre. The asset must be allocated before a depreciation calculation can be run. |

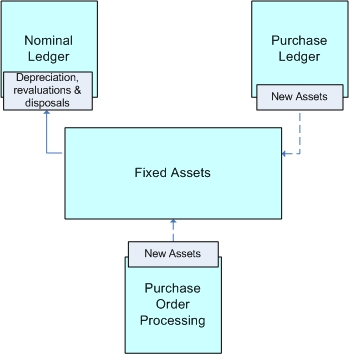

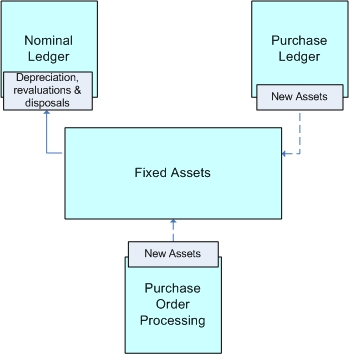

The Fixed Assets module can link to the Nominal Ledger to post depreciation, revaluations and disposals. New assets can also be created from the Purchase Ledger and Purchase Order Processing modules when supplier invoices are posted. The modules only link to Fixed Assets if the respective option is ticked on the System - Maintenance - Company Profiles form.