Box

Description

Profile

A unique reference that identifies the profile.

Description

The profile description of up to 25 characters.

Pay Method

An option that determines the pay method for employees associated with this profile. You can select one of the following from a list: A (for Autopay), B (for BACS), C (for Cash) or Q (for Cheque).

The options available depend on those selected in the Permitted Payment Method box on the Options Page 3 tab of the Set Options form.

Holiday Entitlement

The number of days or part-days holiday entitlement for employees associated with the profile.

Nominal Bank A/C

A reference that identifies the bank account to be used for payments made to employees associated with the profile. You can select from a list. This only applies if you have the Cashbook application integrated with the Payroll application and the Cashbook option is selected on the profile. Bank accounts are created using the Processing command in the Cashbook application.

SSP Days

The number of SSP working days that apply to employees associated with the profile. You can enter a number from 0 to 7. This is used to calculate the SSP daily rate.

Qual. Days Profile

The default SSP qualifying days profile for employees associated with this profile. You can select from a list. Qualifying days profiles are defined using the Qualifying Days Profile command on the Maintenance submenu of the Payroll application.

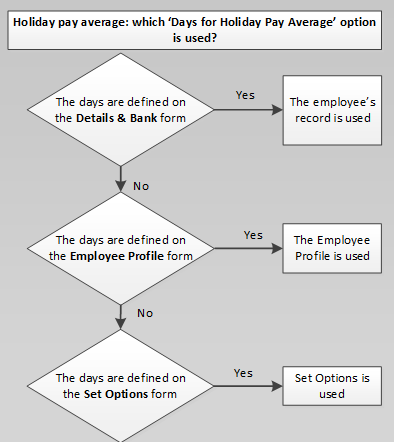

The number of days used in the calculation of the daily average for holiday pay for weekly paid employees associated with the profile. This is also used on the Holiday Pay Average report.

This setting can also be defined on:

The Set Options form - which is used for all employees in weekly payrolls in Payroll unless the option is overridden on their employee record or on the relevant Employee Profile.

Employee records - which is used only for the relevant employee record.

This option is used for weekly payrolls only.

Director

An option that determines whether the employees associated with the profile are directors.

Company Car

An option that determines whether the employees associated with the profile have a company car.

COMP Member

Not used.

COMP NI to COSR at EOY

Not used.

Trade Dispute

An option that determines whether all employees associated with the profile are in a trade dispute with the employer. Tax refunds are not paid to employees in a trade dispute. You can also specify this setting at group level or per employee.

Cashbook

An option that determines whether payments made to employees associated with the profile are transferred to the Cashbook application. This only applies if you have the Cashbook application integrated with the Payroll application.

Cashbook Type

A reference that identifies the cashbook type for pay transferred to bank accounts in the Cashbook application. This only applies if you have the Cashbook application integrated with the Payroll application and you have selected the Cashbook option. Cashbook types are defined using the Cashbook Types command in the Cashbook application.

Keep Project/Keep Department

Options that determines whether the corresponding analysis dimensions defined with employees associated with this profile are retained after a payroll update. If this option is not selected, each time the payroll update is carried out, the employee analysis dimensions are cleared.