Box |

Description |

Sort Code |

The sort code of the company's bank account. You can select

from a list. This is used for employees paid by Autopay or BACS.

Bank details are defined using the Payroll

- Maintenance - Bank Details form. |

Bank Account No. |

The company's bank account number. This is used for employees

paid by Autopay or BACS. |

Bank Account Name |

The name of the company's bank account. |

BACS System |

An option that determines the Banker's Automated Clearing

System (BACS) in use and therefore the format of the files created

when you use the Payroll

- Payment Reports - Produce and List BACS command.

You can select one of the following from this list:

AIB Bank of Cyprus Bank Ireland BankWare BBMII Lite BOS BOS Commercial Bankline (Bankline is a product from NatWest

and The Royal Bank of Scotland that will replace their older

BACS products including NW Autopay, NW Payaway, NW Payment

Manager, Royline, and Royline for Windows) Bankline Ad Hoc (The key benefit from using ad-hoc bulk

payments compared to the standard bulk payments is that you

do not have to use an existing Bankline bulk list (payment

template). You can upload payments from one bank account to

multiple beneficiaries without having to first of all set

up each payee in Bankline that are already set up in Opera)

Clydesdale Co-op Lloyds TSB (works

with 'LloydsLink' or 'Lloyds Commercial Banking Online (CBO)') HSBC (HSBCnet) Metro Bank Northern Bank (Northern

Ireland) NW Autopay NW Payaway (If you

use this product you must change this option to 'STDBACS RTI'

after switching on Real Time Information.

This is because the NatWest Payaway product works with the

Pegasus STDBACS RTI format that includes a reference, which,

along with other information, is used to create a reconciliation

reference when the payment information is sent to HMRC. HMRC

use the reconciliation reference to check the payment against

the information in the Full Payment Submission). NW Payment Manager Royline Blk Royline Win Blk Royline Std Royline Win Std Santander (This works in MULTIBACS (multiple

payments) format with the Santander online banking application

called ‘MyBusinessBank’) STDBACS STDBACS RTI Standard 18 (The Standard 18 format includes

the random string used for RTI purposes, which is a HMRC requirement

for employers who use a Service User Number when paying employees

by BACS. This format is currently supported by Allied Irish

Bank, Bank of Scotland, Bank of Ireland, Barclays Bank, HSBC,

Lloyds TSB and BACS Approved Solution Suppliers (BASS).

You must only use this if your bank or BASS has told you that

the format is suitable and has given you a (SUN) Service User

Number.If you do not have a SUN choose

the option for your bank from the BACS

System list) Yorkshire.

Important: BACS files created

in Payroll are mostly in bulk format. This means that your bank

statement will have a single debit entry even when many employees

are paid. Where the list item is suffixed with "Std",

they are in Standard, or non-bulk format. However these formats

are also available in bulk formats - suffixed with "Blk".

Where the list item does not mention either "Std" or

"Blk", the bulk format is used. BACS files created in

non-bulk format have one debit entry for every payment into payee's

bank accounts. |

PAYE Reference |

Your company PAYE reference which identifies your company

to HMRC. If you are uncertain about your PAYE reference contact

your local tax office. The PAYE reference is used by the system

when printing end of year forms such as P14s and P35s.

Important: The PAYE Reference is in 2 parts separated by

a "/". The first part of the reference before the "/"

is your HMRC Office number. The second part after the "/"

should only include your unique reference number supplied by HMRC;

it must not include the HMRC Office number. |

Tax District |

The company's tax district. As with the PAYE reference,

this is used on end-of-year forms and identifies the tax district

applicable to your company. |

Accounts

Office Ref. |

The accounts office reference, which must be entered for

Real Time Information

submissions. If it is not entered here you will receive an error

from the Government Gateway

similar to 'Ref

1186 AORef is mandatory in FPS' when you make a Real Time Information submission.

This is also needed for P32 consolidation purposes

in Opera. |

ECON |

The employer's Contracting Out Number as notified by the

Contracted Out Employment Group (COEG) if you are operating an

occupational pension scheme. |

Child

Maint. ER Ref. No. |

This box is for the employer's child maintenance reference

number supplied by the Child Maintenance Service.

Only one child maintenance reference number is provided

which must be used for all payroll groups so this box is enabled

only for the main group. All groups will use the reference entered.

This code is included on the Deductions

from Earnings Orders report that displays employees' deductions

from earnings orders. The report can be faxed or posted to the

Child Maintenance Service

or uploaded to its website if DEOs are deducted under the 2012

scheme.

See the Deductions

from Earnings Orders (DEOs) for Child Maintenance Schemes

help topic for details about the 2012 Deductions from Earnings

Orders. |

Current

Tax Year |

The current tax year. For example enter the 2013-2014 tax

year as '1314'. The system automatically inserts the current tax

year when you enter the set options procedure. This only occurs

the first time you enter set options and is based on the current

system date.

The option controls which NI, PAYE and Statutory

Payments tables to use. |

P32 Processing options |

P32

Co. Consolidation ID |

The ID for the consolidation company. This defaults to the

same ID as the current company.

Accounts Office references must be identical for

consolidating companies. |

P32

Payment Frequency |

An option that determines the P32 payment frequency. You

can select monthly or quarterly. |

P32

By Income Tax Month |

An option that controls how some weeks in weekly, two-weekly

and four-weekly payrolls are included on the P32

Processing form. The weeks affected span different tax months

- weeks 5, 9, 18, 22, 27, 31, 35, 40, 44 and 48. This option does

not affect monthly payrolls.

If this option is ticked, the form includes the

week numbers in the month where the usual pay date for the week

falls. In the week numbers mentioned, this means that the week

may not be included in the month as it is displayed on the official

P32 form. This is best explained with an example.

To comply with HMRC guidance, tick this option

if you run weekly, two-weekly or four-weekly payrolls. |

RTI option and email address |

Use

Real Time Information |

Must be selected. All employers must operate their PAYE

schemes in real time. |

Sender

e-mail for payslips and P60s |

Opera 3 includes a feature to send password-protected payslips and P60s

in PDF format to your employees.

The sender's email address and name are what the employee will

see when they receive their welcome emails, password emails when

requested, and payslips and P60s.

Tip: To set up Payroll

for email, follow the steps in the To

Set up Payroll for Emailing Payslips and P60s Help topic.

This feature

is available in Opera 3. This feature

is available in Opera 3.

|

Box |

Description |

Hours

and Minutes |

An option that determines whether minutes are used for units

within payments and deductions. For example, if selected 1.25

means one hour and twenty-five minutes. If this option is cleared,

the system uses decimals. In this case 1.25 means one hour and

a quarter (one hour fifteen minutes). If the Payroll application

is integrated with the Costing application, the Hours

and Minutes box on the Set Options

form in the Costing application will be set in the same way. This

only applies if the Costing application is installed and activated. |

Use Departments |

An option that determines whether departments are in use

within the Payroll application. If you have the Nominal application

integrated with the Payroll application and you are using cost

centres, you can choose whether to analyse

your payroll by nominal ledger cost centre alone, or by department

within cost centre. If you want to analyse

department within cost centre, select this Use

Departments option to analyse

values to many departments within each cost centre. The number

of departments available is determined by how many you create

using the Department Details command

on the Maintenance menu in the Payroll

application. |

Allow Employee Holiday Days |

An option that determines whether you can override the default

holiday days entitlement on the employee record. The default is

assigned from the employee profile associated with the employee. |

Allow N/ L Masking |

An option that determines whether nominal codes identified

in the Payroll application are subject to 'masking'. Masking allows

you to select the nominal account to which the analysis values

are posted by manipulating the analysis codes. |

Post Blank Control Account Cost Centres |

An option that determines whether you want to post payroll

values to nominal control accounts that do not have cost centres.

With this option cleared, the application requires both a cost

centre with the nominal code. If no cost centre is defined in

the Nominal Codes function, the system takes the cost centre from

the department. The cost centre must be defined in the Nominal

Codes or on the department record before you can begin processing

in the Payroll. |

Use Groups |

An option that determines whether you want to operate a

multi-frequency payroll (for example, with weekly and monthly-paid

employees). The application creates a default group, but you must

create a group record for each frequency you wish to use using

the Group Details command on the Maintenance submenu. If groups are in use,

you can define certain options on a group basis. The options for

the default group apply in all cases where group options have

not been defined. |

Current

Week in Holiday Average |

An option that determines whether the current week's pay

is included when calculating the holiday pay average. |

Trade Dispute |

An option that controls whether all employees in the group

are in a trade dispute with the employer. Tax refunds are withheld

from employees in a trade dispute. You can also set this option

at employee profile level or per employee. |

Allow

Off-Payroll Workers |

An option that controls whether off-payroll workers can

be maintained in Payroll.

If this option is selected, payroll records can be defined for

off-payroll workers using the Payroll

- Processing - Employee Details & Bank form.

A new off-payroll worker is assigned 'Start Declaration C' status for

the P45, and their tax code is set to 'BR Cumulative'.

For off-payroll workers, fees charged to clients (known as 'deemed direct

payments') must be subject to tax and NI deductions, and employer NI must

be paid.

Off-payroll workers are processed in Payroll in the 2020-21 tax year

as any other employees, with these differences:

Off-payroll workers are responsible

for managing any student loans, postgraduate loan deductions and pensions,

so these areas of Payroll cannot be used for them. In the FPS file sent to HMRC

for each pay period, these workers are indicated in the submission

as off-payroll workers.

For the employer, these differences apply:

Employers cannot offset the

Employment Allowance against Employer NI paid for off-payroll workers.

The Employment Allowance

form in P32 Processing excludes

Employer NI paid for off-payroll workers. Employers are not responsible

for student loans or postgraduate loan deductions for off-payroll

workers. Employers are not required

to pay statutory payments to off-payroll workers. Employers are not required

to enrol off-payroll workers into pensions.

|

Use

Advanced Pension Processing |

If Advanced Pension Processing is not used you must manually

add pension deductions to each employee on the Payroll

- Processing - Pay & Deductions form. This need not be

done if Advanced Pension Processing is used.

Advanced Pension Processing makes it possible to easily set

up pension schemes, link these schemes to your employees, and

manage the employer and employee contributions that are paid into

the schemes. Advanced Pension Processing also allows you to send

enrolment and contribution files to NEST and NOW: Pensions.

To set up Opera for auto enrolment we recommend

that you use Advanced Pension Processing.

Please see the Starting

with Advanced Pension Processing Help topic for steps to change

to using this feature.

Please see the Starting

with Advanced Pension Processing Help topic for steps to change

to using this feature.

|

Use Auto

Enrolment Processing |

An option that enables the facilities for pension auto enrolment

in the Payroll.

If this is selected, you can use the Payroll

- Global Changes - Auto Enrolment Updates command to auto-enrol

eligible employees into approved pension schemes. You will also

be able to maintain their pension details and deduct both employee

and employer pension contributions.

Important: Do not

select this option before the pay period in which your staging

date falls. |

Align

Pay Reference Period with Tax Period |

Important: If

you set up Opera for Auto Enrolment Processing before this option

was introduced then please contact your Pegasus partner before

using it. In this situation there may be some manual amendments

needed after selecting this option.

If this option is selected the PRP is aligned with the tax period

(from the 6th of a month to the 5th of the following month).

4/4/5

Payrolls

You should select this option if you run a 4/4/5 monthly payroll

(where employees are paid monthly but are sometimes paid for four

weeks’ work and at other times for five weeks’ work). Opera can

then assess employees' earnings for auto enrolment using the monthly

auto enrolment thresholds (for 4/4/5 payrolls Opera cannot assess

monthly paid earnings using multiples of weekly auto enrolment

thresholds).

This option is enabled if the Use Auto Enrolment Processing

option is used on the Set Options

form. |

COMP Scheme in Use |

This option is ignored.

This option allowed COMP schemes to be used. COMP

schemes are no longer allowed. |

Employer Pays COMP |

This option is ignored.

This option controlled whether the employer paid both the employee's

and employer's COMP contributions. COMP schemes are no longer

allowed. |

Entitled to Small Employer's Relief |

An option that determines whether your company is entitled

to the Small Employer's Relief for statutory payments. |

Use

Full SMP Processing |

An option that determines whether you want the application

to calculate Statutory Maternity Pay entitlement for employees

expecting a baby.

If the option is cleared, you must enter SMP payments manually

when they apply in any given period. You can also record the maternity

absence in the employee's diary within the Personnel application.

If the option is selected, a number of areas of the payroll

are changed to record settings and parameters that enable the

application to automatically calculate an employee's SMP entitlement

for the pay period.

The Payroll - Processing

- SMP Details form is also available to record the SMP details

for an employee. |

Pay SMP/SPP/ SAP/ASPP to End of Period |

An option that determines whether Statutory Maternity Pay,

Statutory Paternity Pay (for births or adoption), Additional Statutory

Paternity Pay (for births or adoption) or Statutory Adoption Pay

is paid for maternity/paternity pay weeks either up to and including

the usual payment date or up to the end of the pay period.

This option covers circumstances that could otherwise leave

an employee paid less SMP, Statutory Paternity Pay (for births

or adoption), or SAP than expected. For example, if employees

are paid mid-month but the pay is intended to cover wages to the

end of the month, selecting this option will ensure they receive

all due statutory payments.

Shared Parental

Pay (ShPP) has replaced Additional Statutory Paternity Pay. ShPP allows

eligible partners to share parental leave. The rules for adoptions are

similar to new births.

For details about ShPP, please visit www.gov.uk/shared-parental-leave-and-pay/overview.

For instructions on setting up ShPP in Opera please see the How

to Set Up Shared Parental Pay Help topic.

Important: If the

option is cleared, the statutory payments are only be paid up

to the payment date. |

Use Full SPP (Birth)

Processing |

An option that determines whether you want the application

to calculate Statutory Paternity Pay (SPP) entitlement for employees.

If the option is cleared, you enter SPP payments manually when

they apply in any given period. You can also record the paternity

absence in the employee's diary within the Personnel application.

If the option is selected, a number of areas of the payroll

are changed to record settings and parameters so that SPP is automatically

calculated for those entitled employees for the pay period.

The Payroll - Processing

- SPP (Birth) Details form is available to record the SPP

details for an employee. |

Use Full SSP Processing |

An option that determines whether you want the application

to calculate Statutory Sick Pay (SSP) entitlement for employees.

If the option is cleared, you must enter SSP payments

manually when they apply in any given period. You can also record

the sickness days in the employee's diary in the Personnel application.

If the option is selected, a number of areas of the payroll

application are changed to record settings and parameters that

enable the application to automatically calculate an employee's

SSP entitlement for the pay period.

The Payroll - Processing

- SSP Absence form is also available to record the SSP sickness

days for an employee. |

Pay SSP to End of Period |

An option that determines whether Statutory Sick Pay (SSP)

is paid to the end of the current period or only up to and including

the usual payment date.

Making SSP payments up to the usual payment date

can cause problems if employees are paid in arrears. In these

circumstances, the option can be selected so they receive any

SSP entitlement up to the end of the pay period instead.

Important: If the

option is cleared, SSP will only be paid up to the payment date. |

SSP Qualifying Days Pattern |

Only available if Use Full SSP Processing

is selected.

An option that determines the default qualifying

pattern for Statutory Sick Pay calculations for the currently

selected group. You click to select each day that qualifies for

SSP and the application displays the number of days in the Days box alongside.

The default selection is Monday to Friday (5 days). |

Split-Week

Payments of SMP/SAP |

Only available if Use Full SMP Processing

or Use Full SAP Processing is selected.

This option defines whether split Statutory Maternity Pay (SMP)

and Statutory Adoption Pay (SAP) payments are permitted for the

payroll group to align the payments with wages and salary payments.

Split SMP payments were introduced by the Work

& Families Act.

The employer, not the employee, decides whether

to split SMP and SAP payments. |

Use Full SPP (Adopt)

Processing |

An option that determines whether you want the application

to calculate Statutory Paternity Pay (SPP) for adoption entitlement

for employees adopting a child. If the option is cleared, you

can enter SPP for adoption payments manually when they apply in

any given period. You can also record the absence in the employee's

diary in the Personnel application.

If the option is selected, a number of areas of the payroll

are changed to record settings and parameters that enable the

application to automatically calculate an employee's SPP (Adopt)

entitlement for the pay period.

The Payroll - Processing

- SPP-Adopt Details form is available to record the SPP for

adoption details for an employee. |

Use

Full SAP Processing |

An option that determines whether you want the application

to calculate Statutory Adoption Pay (SAP) entitlement for employees

adopting a child.

If the option is cleared, you can enter SAP payments manually

when they apply in any given period. You can also record the absence

in the employee's diary in the Personnel application.

If the option is selected, a number of areas of the payroll

are changed to record settings and parameters that enable the

application to automatically calculate an employee's SAP entitlement

for the pay period.

The Payroll - Processing

- SAP Details form is available to record the SAP details

for an employee. |

Use Full ASPP

(Birth) & (Adopt) Processing |

Shared Parental

Pay (ShPP) has replaced Additional Statutory Paternity Pay. ShPP allows

eligible partners to share parental leave. The rules for adoptions are

similar to new births.

For details about ShPP, please visit www.gov.uk/shared-parental-leave-and-pay/overview.

For instructions on setting up ShPP in Opera please see the How

to Set Up Shared Parental Pay Help topic.

|

Box |

Description |

Pay Period |

The pay frequency for the group. You can select one of the

following from a list: Weekly, Fortnightly, Four-weekly

or Monthly. If you wish to use a multi-frequency

payroll, you must select the Use Groups

option described earlier. Each employee must be assigned to a

group and each group can then have its own frequency. When you

subsequently carry out any payroll processing, you will be prompted

to choose the group(s) to which processing applies. For example,

if you pay some employees weekly and some monthly, you must set

up one group for each frequency. We strongly advise you not to

change the pay frequency once you have begun processing for a

group or company. |

Permitted Payment Method |

An option that determines the permitted payment methods

that can be used within employee profiles. You can include the

corresponding code from the following list: A

Autopay, B BACS, C

Cash or Q Cheque. For

example, to allow payment methods of BACS, Cash, and Cheques,

you would enter BCQ in this box.

Important: Barclays 'Bobs' payments (payment method

'O')

are no longer supported by Barclays Bank. If this payment method

is in this box the message Invalid

Pay Method entered is displayed if you try to change anything

on the Set Options form. You must remove

payment type 'O'

to save any changes. |

Keep ... |

Pay Period Summary Image |

The number of pay periods for which you wish to retain the

'this period's summary' image. The application will retain the

this period's summary image for the number of periods specified.

You can view the information using the Processing

- Action - History command.

You must keep at least one year's history. |

Printed Payslips |

The number of pay periods to keep payslip images in Opera. |

Web/E-mail

Payslips |

This option is used to record the number of pay periods

to keep payslips sent to employees by email. |

Web/E-mail

P60s |

This option is used to record the number of tax years to

keep P60s sent to employees by email.

Tip: You can view each

employee's P60s

on the Web P60s form from the Payroll

- Processing - History form. |

Statutory

Payments |

The number of years you want the payroll to retain a history

of Statutory Maternity Pay, Statutory Sick Pay, Statutory Paternity

Pay, and Statutory Adoption Pay. This must be a minimum of three

years. |

Payments

and Deductions |

The number of periods you want the payroll to retain a history

of your employees' payments and deductions. |

Tax

Year History |

The number of years of tax history you want to retain for

employees on the Payroll - Processing

- Tax Year History form. Tax year history includes all pay

details for each employee as at the tax-year end. The 2019-20

tax year is the first tax year for which history can be retained. |

| |

L.E.L.

for Pension

U.E.L. for Pension |

The lower and upper earnings limit for pension calculations

where either of these differ from the LEL and/or UEL held in the

NI tables. The limit(s) you enter here apply to all employees

who do not have a LEL and/or UEL entered on their employee record.

The application refers to the employee record for

a LEL and UEL. If either contains a value, the values for both

limits are taken from the employee record. If both limits are

zero on the employee record, the application uses the limits you

define here and if these are also zero, the limits set in the

NI tables are used.

Advanced Pension Processing:

These values are used for pension calculations only if the Use

Advanced Pension Processing option on this form is not

selected. If that option is selected, the employee can be allocated

a pension scheme which includes a cap for pension calculations.

See the Payroll

- Maintenance - Pension Scheme Help topic for more information. |

Max. Charity Contributions P.A. |

The maximum amount of charity contributions an employee

can make and for which tax relief applies. The exception report

highlights any employee who is making charity contributions in

excess of this amount. If no value is entered, this means no limit

applies. |

Max. Tax Refund for Starter |

The maximum tax refund that can be paid for a new starter.

The exception report highlights any new employee with a tax refund

greater than this amount. If left blank, any

value tax refund is permitted. |

Value For Low Gross Pay |

The value used to define a low gross pay threshold. A message

is generated on the exception report where an employee's gross

pay falls below this amount. If left blank, no check is performed. |

Value for Low Net Pay |

The value used to define a low net pay threshold. A message

is generated on the exception report where an employee's net pay

falls below this amount. If left blank, no check is performed. |

Max. Cheque Value |

The maximum value of a cheque that can be produced. Enter

the value in whole numbers. If an employee

is being paid by cheque and the net pay exceeds the maximum cheque

value, no cheque will be printed. If no value is entered, this

means no upper cheque limit applies. |

Alternative Co. ID for

N/L |

An identifier that determines which Nominal application

company is used for payroll postings. You can incorporate several

payrolls (each operating for a different company identifier) into

one Nominal application. For example, you might have company 'Y'

for weekly payrolls and company 'Z' for monthly payrolls, both

making postings in the nominal ledger for company 'A'. |

Tax

Regulatory Limit % |

This limit applies to all tax code types, including D codes,

BR, OT. The calculation commands limit the amount of tax that

can be deducted to this percentage of each employee’s gross

pay or pension. This applies to both the main calculation (Payroll – Calculation) and

the individual calculation (Payroll

– Processing – Calculate) commands. |

Holiday

pay averaging |

Weeks

for Holiday Pay Average |

The number of weeks pay used in the calculation of the average

holiday pay for weekly paid employees. This is also used

on the Holiday

Pay Average report.

This option is used for weekly payrolls only.

From 6 April 2020, the number of weeks that must be used to calculate

average weekly earnings for holiday pay - the 'Holiday Pay Reference Period'

- increases from 12 weeks to 52 weeks.

This change is designed to even out seasonal variations in pay for workers

in seasonal occupations without fixed hours or pay.

To not use holiday pay averaging, set this option to zero.

To not use holiday pay averaging, set this option to zero.

|

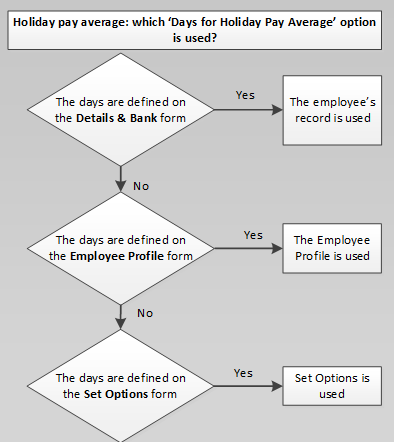

Days

for Holiday Pay Average |

The number of days in a working week used in the calculation

of the daily average for holiday pay for weekly paid employees.

This is also used on the Holiday

Pay Average report.

This setting can also be defined on the following:

This makes it possible to record different length

of the working day for different employees, For example, let's

say that most of your weekly-paid employees work 5-day weeks but

some others work 3-day weeks, and just one employee works 2 days

a week. You would create an Employee

Profile for those employees who work 5 days and another

profile for those who work 3 days - and update the Days

for Holiday Pay Average accordingly, and for the employee

who works 2 days you would update the number of days just on their

employee record.

This option is used for weekly payrolls only.

|

Holiday

Pay Payment Number |

The number of the payment profile used for holiday pay entitlement.

This option is enabled when the Weeks

for Holiday Pay Average box has been updated. It is used

for weekly payrolls only. |

| |

Deduct Admin Fee |

An option that determines whether to deduct an administration

fee for attachment orders. This setting will apply to all groups.

The fee itself is defined in the following boxes. |

Standard Fee |

The standard administration fee to apply when attachment

orders are calculated for employees. This only applies if the

Deduct Admin Fee option is selected.

Does not affect Scottish attachment orders. |

Scottish Fee |

The administration fee to apply when Scottish attachment

orders are calculated for employees. This only applies if the

Deduct Admin Fee option is selected. |

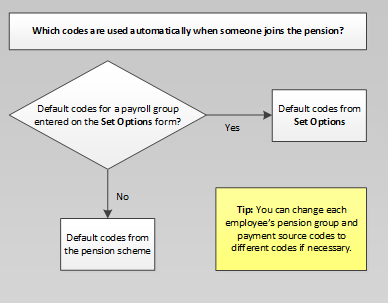

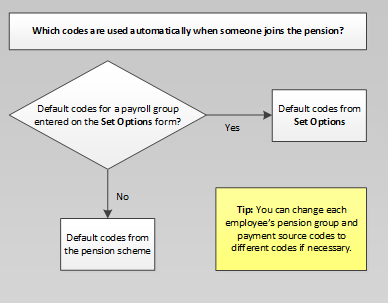

Pension Export File Settings for this Payroll Group |

You can optionally enter default pension group and payment

source codes for specific payroll groups. If these default codes

are not entered the codes on the pension scheme itself are instead

used when you add the employee's pension scheme to their record.

You can change the codes for each employee afterwards using the

Payroll

- Processing - Action - Pensions - Employee Pensions - Additional

Details form.

Why

you might enter default codes on the Set Options form

|

| |

Pension Group |

Enter a default pension group for NEST

pensions or NOW: Pensions

for the payroll group, if required. |

| |

Payment Source |

Enter a default payment source for NEST

pensions for the payroll group, if required. This is not required

for NOW: Pensions.

Payment Sources are maintained on the Payroll

- Maintenance - Pension Payment Source form.

Payment Sources are maintained on the Payroll

- Maintenance - Pension Payment Source form.

|

| |

Payroll Code |

Enter the payroll code used when setting up the scheme with

NOW: Pensions. You

may have used separate payroll codes for different pay frequencies,

for example 'MNTH' for a monthly payroll or 'WEEK' for a weekly

payroll.

This is not required for NEST

pensions. |

This feature

is available in Opera 3.

This feature

is available in Opera 3. Please see the Starting

with Advanced Pension Processing Help topic for steps to change

to using this feature.

Please see the Starting

with Advanced Pension Processing Help topic for steps to change

to using this feature.