Transaction Allocations

Allocation is the process of matching outstanding credit notes, discount,

payments, refunds or credit adjustments to outstanding invoices or debit

adjustments. Once matched, the transactions are considered to be 'cleared'

and are removed from the data files when you use the End

of Period command in the Sales Ledger. This happens provided the

transactions exceed the number of periods specified in the Keep

Transactions box on either the Options

form associated with each customer's record on the Processing

form or the Sales Options form.

Allocations can be done at the same time as entering a receipt or refund

using the Receipt and Refund

commands on the Action menu associated with

the Customer form, provided the On

Account option is cleared. Alternatively, you can use the Allocate command on the Action

menu that provides access directly to the Allocations

form. You can then allocate existing transactions, including other credits,

such as credit notes.

Settlement discount is automatically taken into account according to

customer settlement discount terms. Click here

to see a flowchart of the checks that are made to decide whether settlement

discount should be included on an invoice. You can also use the allocation

process to put on hold (and subsequently release) disputed transactions.

Disputed transactions are available for allocation but are ignored when

you use the Exhaust command on the Action

menu associated with the Allocations form. The

Allocations form displays all the outstanding

transactions for the selected customer account. To include a transaction

in an allocation action, click to select the transaction in the grid.

You then select the relevant command from the Action

menu according to what you want to do.

Use this command |

To |

Cancel Allocation |

Cancel the allocation marker for the selected transaction. |

Pay Full |

Allocate the full value of the transaction as paid. |

Pay Part |

Allocate part of the transaction value. You enter the amount

to be allocated in the Part Pay box

that appears.

Unless settlement discount is being taken, the

Part Pay box is automatically updated

with a calculated part payment amount. If settlement discount

is being taken, you must enter the part payment amount. |

No Disc |

Settlement discount is calculated if a receipt pays one

or more invoices in full and settlement discount is due. If your

customer has paid you in full, you can cancel the settlement discount

calculations by using this command. The No

Disc command will revert settlement discount that

has been calculated for all the lines displayed in the grid.

This command only applies to allocations made when

using the Receipts Allocations

form (posting a new receipt in the Sales

- Processing - Receipt command). |

Exhaust |

Allocate the receipt to as many outstanding invoices as

possible starting with the oldest outstanding item, until the

value of the receipt is exhausted. The command does not part-pay

invoices; it pays the oldest outstanding items provided these

can be fully paid by the value of the receipt. If an item cannot

be fully paid, the next oldest outstanding item (which can be

paid in full) will be paid instead. Example

...

This command only applies to allocations made when

using the Receipts Allocations

form (posting a new receipt in the Sales

- Processing - Receipt command).

Important: The Exhaust command ignores transactions that

are in dispute, those in a foreign currency, and Brought Forward

Balance transactions. Brought Forward Balance transactions are

created by the End of Period

command for accounts that are not set as Open Item accounts. |

Accept |

Accept the allocations, assuming that the value alongside

the to Allocate title is zero. If the

balance to allocate is not zero, you must amend your entries otherwise

you cannot accept them, except as noted below for foreign currency

transactions. |

(Un)Dispute |

Place the selected transaction under dispute, or, if already

in dispute, release the transaction. You can select a reason description

from the Reason Code list box. |

Due Date |

Change an invoice's due date to today's date or later. |

Allocating Foreign Currency Transactions

In you use the multi-currency application, when you are allocating foreign

currency invoices, you can view values in both the home and foreign currency.

The exchange rate shown is the one that was current when the transactions

were posted. Allocations can then be made in the transaction's currency

or in another currency including the home currency. If you allocate to

an invoice in the transaction's currency, the system compares the exchange

rate prevailing at the time the individual postings were made.

If a discrepancy arises, the loss or gain is posted to the Nominal Ledger

account defined for the foreign currency concerned on the Exchange

Rates form in the System Manager. If you allocate a receipt to

an invoice in a currency other than the transaction's currency, the system

converts both currencies to the home currency using the exchange rates

prevailing at the time the debit and credit postings were made and posts

the value of any difference to the nominal account identified in the Exchange Gain/Loss box on the Adjustment

Names form.

Allocating Advanced Transactions

You can allocate debits to credits, in part or in full, regardless of

whether they are 'advanced' transactions. For example, you can allocate

a payment posted for the current period to an invoice that has been posted

to the next period. Similarly, a payment posted to the next period can

be allocated to invoices in the current period. Advanced transactions

are only possible if the Allow Advanced Posting

option is selected on the Sales Options form.

Disputed Transactions

You can use the Allocations command to mark

transactions that are in dispute.

You can assign a reason code to a disputed transaction. If the Mandatory Reason Code

option is selected on the Sales

Ledger - Utilities - Set Options form, you must select a reason code

when you mark a transaction as disputed. Otherwise a reason code is optional.

A note is added to the customer account when a transaction is marked as

disputed or when the dispute indicator is cleared.

Disputed transactions are ignored in these commands:

The Exhaust

command used to allocate a receipt to one or more invoices from the

Sales Ledger - Processing

form.

The Print

Debtors Letters report from either the Reports

menu or the Credit Management Centre.

You

can add new reason codes using the Sales

Ledger - Maintenance - Reasons form.

You

can add new reason codes using the Sales

Ledger - Maintenance - Reasons form.

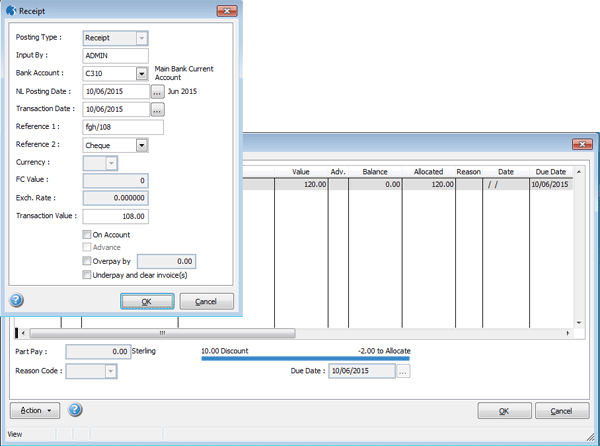

Invoice ‘To allocate’ value & VAT adjustments for Settlement Discount

When receipts or payments are posted and allocated to invoices, the

Allocations form shows the balance to allocate.

When receipts or payments are posted within settlement terms, the form

shows both the settlement discount taken, and the balance to allocate.

However, once the transactions are allocated together the ‘to Allocate’

value will be shown as a negative value. The reason is just mathematical.

You need to ignore that it is negative when understanding what the VAT

adjustment must be.

Using an example to explain why this is.

Your customer buys standard rate VAT (20%) goods for £100 with 10% settlement

discount. They pay the next day and take £10 goods discount and reduce

the VAT by £2. The VAT should now be £18 ((£100 - 10%) * 20% ) rather

than £20 on the original posting. £108 will now clear the invoice.

The £120 invoice is fully allocated with the discount of £10 (£120 -

£10), the allocated value is then subtracted from the actual receipt value

(£110). So £108-£110 = -£2.

Show ...

You

can add new reason codes using the Sales

Ledger - Maintenance - Reasons form.

You

can add new reason codes using the Sales

Ledger - Maintenance - Reasons form.