Option

Description

Up to Tax Month

Select the month that the Employer Payment Summary is being submitted for. This will default to the latest month in Payroll. If you pay HMRC quarterly rather than monthly (and the P32 Payment Frequency option on the Payroll - Utilities - Set Options form is set to 'Quarterly') then the quarter number is displayed in the list where appropriate.

Recovered amounts

Enter the recoverable amounts for Statutory Payments, National Insurance contributions (the figures that are displayed initially are taken from the updated figures on the Payroll - P32 Processing form but you can change them if required).

You need to enter CIS Deductions Suffered if necessary - this amount is not derived from the P32 Processing form.

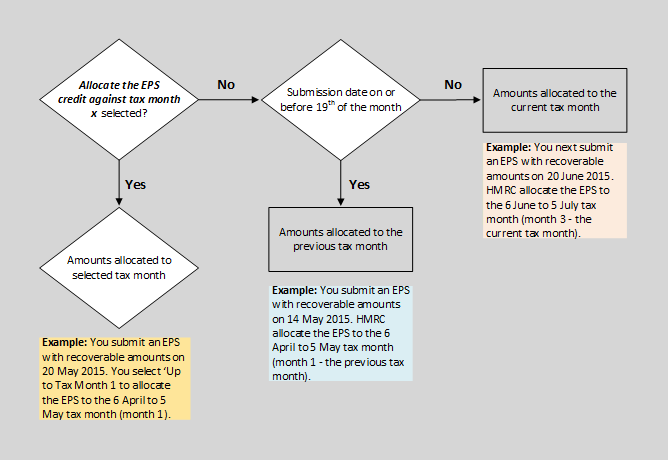

Allocate the EPS credit ... against tax month x

When this box is selected the recoverable amounts are allocated against the month in the Up to Tax Month box. When this box is cleared the tax month that the recoverable amounts are allocated to depends on the submission date.

This flowchart illustrates the tax month that recoverable amounts are allocated against, depending on whether this option is used or when the EPS is submitted.

Bank Account Details

Enter bank details to which refunds will be sent by HMRC if relevant. This information need only be provided once but can also be included each time an EPS is submitted.

The Employment Allowance is currently claimed by employers to reduce their employers secondary Class 1 NICs bill by up to £4,000.

From 6 April 2020, extra checks are needed to ascertain eligibility. Employers can claim the allowance if their secondary Class 1 NICs liability was less than £100,000 in the prior tax year. Employers whose secondary Class 1 NICs liability was £100,000 or more will not be eligible to claim the allowance.

Because of the change, the Employment Allowance is considered to be a type of de minimis State aid because it advantages some businesses over others, which could potentially distort competition and trade within the European Union. This will not apply if the business does not engage in economic activity by putting goods or services on the market.

Businesses must ensure that the £4,000 allowance when added to other de minimis State aid received or allocated in the claim year plus the previous two tax years does not exceed the de minimis State aid threshold for the trade sector.

Employers need to reapply for the de minimis State aid Employment Allowance at the start of each tax year.

HMRC will be responsible for ensuring compliance with the de minimis State aid rules.

You should record the employment allowance that you claim on the

Payroll

- P32 Processing - Employment Allowance form. It will then

be deducted from the total amount shown to be paid to HMRC.

You should record the employment allowance that you claim on the

Payroll

- P32 Processing - Employment Allowance form. It will then

be deducted from the total amount shown to be paid to HMRC.

The Employer Payment Summary (EPS) is used to claim the Employment Allowance.

One of these options on the EPS screen in Payroll must be selected:

Can't claim

Stop claiming

Starting to claim or already claiming for 2021-22.

The trade sector that the de minimis State aid applies to must also be selected (Industrial, Road Transport, Agriculture, Fisheries and aquaculture).

Trade sectors have different de minimis State aid thresholds. An employer can only claim the Employment Allowance if they have at least £4,000 of their de minimis State aid limit for their trade sector remaining. HMRC will offset the allowance claimed against the Employer Class 1 NICs due. Employers must reduce their payment by the amount of allowance they are claiming.

Employers need to reapply for the de minimis State aid Employment Allowance at the start of each year.

The State aid rules don't apply option must be selected if state aid rules are not relevant to the business.

Select one of the following options for the Employment Allowance.

Can't claim

Select this option to signify to HMRC that the Employment Allowance can't be claimed by the company.

Stop claiming

Select this option to signify to HMRC that the company was claiming the allowance but it will no longer be claimed because the business is no longer eligible. Stopping your claim means that no allowance is due, and you must pay all Class 1 NICs as a result.

Important:

1. Do not select ‘Stop claiming’ to indicate that you have claimed

the full allowance for the tax year.

2. Do not select ‘Stop claiming’ to indicate that you are no longer

employing anyone.

Starting to claim or already claiming

Select this option to indicate to HMRC that the Employment Allowance is being claimed for the 2021-22 tax year.

Even if an EPS to HMRC has never been sent to HMRC other than

for the final tax month in a tax year, one must be sent to indicate

the intention to claim the allowance. Otherwise, HMRC will assume

the employer has underpaid their NICs.

Trade sector for de minimis state aid and amount of aid

Select a trade sector and enter the relevant de minimis State aid threshold for the trade sector.

The de minimis State aid thresholds for a trade sector are calculated in Euros so the amount of aid received in the previous years and the maximum allowance for the 2021-22 tax year will need to be converted into Euros using the EU exchange rate published on 1 April.

Trade sector for de minimis state aid

Select the relevant trade sector for de minimis State aid.

State aid rules don't apply

Select if State aid rules don't apply to the business.