Box |

Description |

Bank Sort Code |

The employee's bank account sort code. You can select from

a list. You must select a sort code if the employee is paid by

Autopay or BACS. Sort codes are defined using the Bank

Details command on the Maintenance

menu.

You

can add another bank to the employee record using the Add/Edit Bank command on the Action

menu. You

can add another bank to the employee record using the Add/Edit Bank command on the Action

menu.

|

Account Number |

The employee's bank account number. |

Payee |

The employee's bank account name. This is the name of the

employee's bank account (as printed on the employee's cheque book). |

B/Soc Roll Number |

The roll number of the employee's account with the building

society. |

Bank Reference |

The bank or building society reference allocated to the

payee. Payees paid by NW Autopay require a 4-digit reference which

is written to the output file. |

Address |

The employee's address using up to five boxes of 30 characters.

HMRC requires that at least two address lines must

be entered for each employee for Real Time Information

submissions. This applies if the employee lives in the UK or overseas. |

Postcode |

The employee's post code. Post codes are not mandatory for

Real Time Information

submissions but will be included if they are valid UK codes. If

the post code is not a valid UK code it will not be included in

a Full Payment Submission

(when the FPS is

used for alignment).

Employees living overseas: If the employee

lives overseas then you can still enter their overseas post code

here but it will not be included in the Real Time Information

submission because it will not be a valid UK post code. Employees living overseas: If the employee

lives overseas then you can still enter their overseas post code

here but it will not be included in the Real Time Information

submission because it will not be a valid UK post code.

|

Country |

The country of residence is mandatory only for employees

who live outside of the United Kingdom who are enrolled in a National Employment Savings Trust

pension scheme or NOW: Pensions

scheme. If the employee lives in the UK the country will automatically

be set to 'United Kingdom' in the NEST submission file. |

Employee LEL |

The employee's lower earnings limit for pension calculations.

This is used for the employee's and employer's pension calculations.

If you make no entry here, the limits on the Set

Options form are used instead. If they are zero, the limits

on the NI tables are used. |

Employee UEL |

The employee's upper earnings limit for pension calculations.

This is used for the employee's and employer's pension calculations.

If you make no entry here, the limits on the Set

Options form are used instead. If they are zero, the limits

on the NI tables are used.

If

the Use Advanced Pension Processing

option on the Payroll

- Utilities - Set Options form is selected, the employee can

be allocated a pension scheme which includes a cap for pension

calculations. If

the Use Advanced Pension Processing

option on the Payroll

- Utilities - Set Options form is selected, the employee can

be allocated a pension scheme which includes a cap for pension

calculations.

|

Student

Loan Plan 1, Plan 2 and Plan 4 |

Options for students who are in plan 1, plan 2 and plan

4 student loan plans. These settings are used to send new

starter information to HMRC in the FPS.

The

thresholds and rates for the two plans are recorded on the Payroll

- Utilities - PAYE/NI & Statutory Payments form. The

thresholds and rates for the two plans are recorded on the Payroll

- Utilities - PAYE/NI & Statutory Payments form.

|

Postgraduate

Loans |

An option for students who are repaying Postgraduate Loans.

This setting is used to send new starter information to HMRC

in the FPS.

The

thresholds and rates for Postgraduate Loans are recorded on the

Payroll

- Utilities - PAYE/NI & Statutory Payments form. The

thresholds and rates for Postgraduate Loans are recorded on the

Payroll

- Utilities - PAYE/NI & Statutory Payments form.

|

Deceased |

This information is included on the P45 leavers report.

A message is displayed when this box is selected that reminds

you of the importance of ensuring that the correct NI code is

used. No NICs are due on the earnings of an employee who dies

before payment is made but PAYE must still be paid. |

These details are included in Real Time Information

submissions where relevant. Enter the number of normal weekly hours worked

and the passport number, and select the options that are relevant for

the individual concerned.

Box |

Description |

Number of Normal Hours Worked |

The approximate number of hours worked in a week. This information

is included in the Full Payment Submission for each pay period.

A |

Up to 15.99 hours |

B |

16 - 23.99 hours |

C |

24 – 29.99 hours |

D |

30 hours or more |

E |

Other |

The employee will be aligned with one of the relevant HMRC

bands when their details are included in a Full Payment Submission.

If the number of hours worked is either left as blank or entered

as zero, the normal hours worked will be set to 'other' in

the Full Payment Submission.

If

this box is set to zero the employee's number of hours worked

will be set to 'Other'. If

this box is set to zero the employee's number of hours worked

will be set to 'Other'.

|

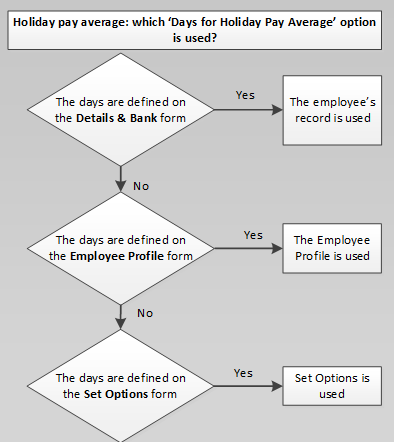

Days for Holiday

Pay Average |

The number of days used in the calculation of the daily

average for holiday pay for the weekly paid employee. This is

also used on the Holiday

Pay Average report.

This setting can also be defined on:

Employee

Profiles - which is used for all employee records linked

to the profile unless the option is overridden on their employee

record. The Set

Options form - which is used for all employees in weekly

payrolls in Payroll unless the option is overridden on their

employee record or on the relevant Employee Profile.

This option is used for weekly payrolls only.

|

Passport Number |

If you have checked the employee's passport, as part of

checking that they have the right to work in the UK, you must

include their passport number here. |

Irregular Employment Payment Pattern |

Payments paid on an irregular basis, for example a seasonal

worker or someone on maternity leave or long term unpaid absence

for three or more months. |

Unpaid

Absence |

The employee's pay has been reduced due to being on unpaid

absence during this pay period.

After Universal Credit has been rolled out nationally this information

will be included in the Full Payment Submission. Check with HMRC

before selecting this option. |

Pension Payment to a Non Individual |

Payments are made to a body, such as personal representative,

trustee or corporate organisation, for example a third party or

non-individual. |

Employee is being paid an Occupational Pension or Annuity |

Pension or income provided from a registered pension scheme

(including annuities, income from drawdown arrangements and trivial

commutation payments) to an individual. |

Employee

is flexibly accessing their pension |

People aged 55 and over can withdraw some or all of their

pension funds (known as flexible drawdown). Select this option

to include an indicator in the next Full Payment Submission

sent to HMRC that this individual has withdrawn pension. |

Pension

Death Benefit |

Select this option to include an indicator in the next Full Payment Submission

sent to HMRC that this individual has received pension death benefit

from their pension provider.

To pay a pension death benefit payment in Opera, please use a

payment profile with the 'Flexible Pension' box selected.

To pay a pension death benefit payment in Opera, please use a

payment profile with the 'Flexible Pension' box selected.

|

Serious

Ill Health Lump Sum |

Select this option to include an indicator in the next Full Payment Submission

sent to HMRC that this individual is being paid a serious ill

health 'lump sum' by their pension provider.

To pay a serious ill health payment in Opera, please use a payment

profile with the 'Flexible Pension' box selected.

To pay a serious ill health payment in Opera, please use a payment

profile with the 'Flexible Pension' box selected.

|

Off-Payroll

Worker |

Select this option for off-payroll workers.

This option is available in the 2020-21 tax year

if the Allow

Off-Payroll Workers option on the Set

Options form is selected for the relevant Payroll Group.

The rules for off-payroll working in the private sector (IR35) change

on 6 April 2020.

These rules changes affect the following:

workers who provide services

through an intermediary clients who receive services

from a worker through their intermediary agencies that provide workers

services through an intermediary.

Before 6 April 2020, public

sector clients must decide their off-payroll workers' status and inform

them of the decision. The public authority is required to deduct relevant

Income Tax and NI before making payments to workers. Private

sector employers should leave that decision to the off-payroll workers'

intermediary.

From 6 April 2020, as well as public sector clients, private medium

and large sized employers must also decide their off-payroll workers'

status. And so both public authorities and medium and large sized employers

are required to deduct relevant Income Tax and NI before making payments

to workers.

Small companies however can still leave that decision to the off-payroll

workers' intermediary.

Small incorporated companies meet two of these criteria:

Small unincorporated companies must have an annual turnover

of less than £10.2m.

|

Late PAYE Reporting Reason |

You must submit your Full Payment Submission

on or before each pay day. If the FPS

is not sent in time a 'Late PAYE reporting reason' must be included in

the FPS when it is sent. HMRC will use the reason supplied to prevent

messages and penalties being issued where they should not be.

The permitted reasons are:

A (Notional payment: Payment

to Expat by third party or overseas employer) B (Notional payment: Employment

related security) C (Notional payment: Other) D (Payment subject to Class

1 NICs but P11D/P9D for tax) F (No working sheet required;

Impractical to report) G (Reasonable excuse) H (Correction to earlier submission).

This can be set for individual employees if necessary, or for all employees

included in an FPS.

To update individual employee

records, tick the Late PAYE Reporting Reason

box on the Additional Info tab of the Payroll

- Processing - Details & Bank form for those employees. Then

choose the relevant reason from the list. When the FPS is sent the late reporting reason

will be included for those employees only. To use the late reporting

reason for all employees in the selected payroll groups, tick the

Specify a late PAYE reporting reason box

on the Payroll

- RTI Submissions - Full Payment Submission

form. Then choose the relevant reason from the list. When the FPS is sent the late reporting reason

will be included for all employees. Any reason selected for an individual

employee will override what is selected here.

Any

late reporting reason used will be cleared by the Payroll

- Utilities - Update command, which completes a pay period ready for

the next pay period. Any

late reporting reason used will be cleared by the Payroll

- Utilities - Update command, which completes a pay period ready for

the next pay period.

|

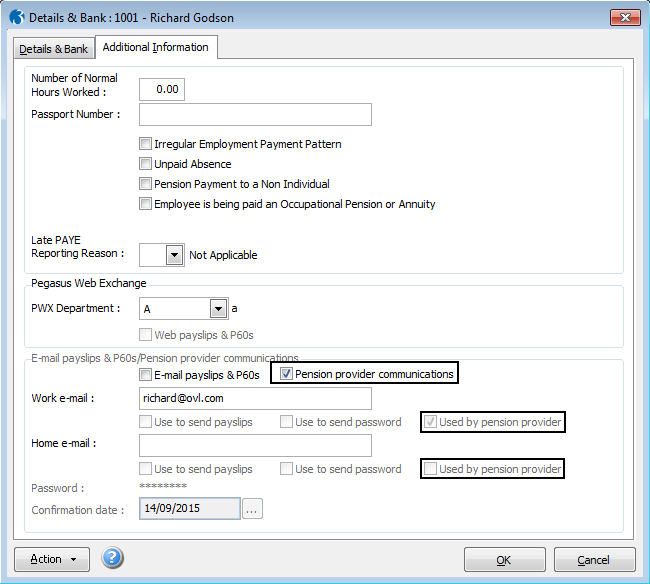

E-mail payslips & P60s/Pension provider

communications

|

E-mail payslips & P60s |

Select the E-mail payslips & P60s

box for employees to receive:

their payslips and

P60s by email the emails that welcome

them to the service the emails that tell

them their password.

Payslips

are generated from the Payroll

- Payment Reports - Payslips form. P60s are generated from

the Payroll - EOY/Special

Reports - P60 End of Year Returns form. Payslips

are generated from the Payroll

- Payment Reports - Payslips form. P60s are generated from

the Payroll - EOY/Special

Reports - P60 End of Year Returns form.

|

Used by pension provider |

The Used by pension provider option

on the Payroll

- Processing - Details & Bank form controls whether

email addresses are included in the NOW: Pensions

contribution file and NEST

enrolment file.

Show

...

For each employee you can enter their work email address,

both work and home email addresses or neither. There are differences

in how NOW: Pensions

and NEST use email

addresses.

NOW: Pensions |

Work or

home |

Home email address is used

by default if the option is selected. To use the work

email address, clear the option for the home address

and select it for the work address. |

Statutory letters and members

communications |

Contribution file |

NEST |

Work and

home |

Both email addresses can be

used if the option is selected for each address. |

Members communications |

Enrolment file |

|

Use to send ... |

Select the Use to send payslips

boxes to use the email address for payslips and P60s.

Select the Use to send password boxes

to use the email address for password reminders.

Both the work and home email addresses can be used

for both payslips and P60s, and password reminders.

To

improve security, if an employee has two email addresses, use

one email address for the password emails, and the other for payslips

and P60s. To

improve security, if an employee has two email addresses, use

one email address for the password emails, and the other for payslips

and P60s.

|

Password |

The password is always saved in an encrypted format. To

change it, select Change Password from

the Action menu.

If

you want to restrict the ability to change passwords to certain

users, remove access to the menu item using the System

- Maintenance - User Profiles form. If

you want to restrict the ability to change passwords to certain

users, remove access to the menu item using the System

- Maintenance - User Profiles form.

|

Confirmation date |

Payslips and P60s can be sent by email only if a confirmation

date has been entered. However, all employees with email details

set up on this form can receive welcome emails and password emails,

even if a confirmation date has not been entered. |

You

can add another bank to the employee record using the Add/Edit Bank command on the Action

menu.

You

can add another bank to the employee record using the Add/Edit Bank command on the Action

menu. Employees living overseas: If the employee

lives overseas then you can still enter their overseas post code

here but it will not be included in the Real Time Information

submission because it will not be a valid UK post code.

Employees living overseas: If the employee

lives overseas then you can still enter their overseas post code

here but it will not be included in the Real Time Information

submission because it will not be a valid UK post code. If

the Use Advanced Pension Processing

option on the Payroll

- Utilities - Set Options form is selected, the employee can

be allocated a pension scheme which includes a cap for pension

calculations.

If

the Use Advanced Pension Processing

option on the Payroll

- Utilities - Set Options form is selected, the employee can

be allocated a pension scheme which includes a cap for pension

calculations. The

thresholds and rates for the two plans are recorded on the Payroll

- Utilities - PAYE/NI & Statutory Payments form.

The

thresholds and rates for the two plans are recorded on the Payroll

- Utilities - PAYE/NI & Statutory Payments form. The

thresholds and rates for Postgraduate Loans are recorded on the

Payroll

- Utilities - PAYE/NI & Statutory Payments form.

The

thresholds and rates for Postgraduate Loans are recorded on the

Payroll

- Utilities - PAYE/NI & Statutory Payments form.