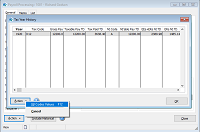

A new Tax Year History view has been added to the Action menu of the Payroll Processing form.

This new view displays year-end pay details by tax year for the employee. The details displayed in this view are recorded at the end of each tax year when the End of Year Cleardown is run in Payroll.

This feature is available from the start of the 2020-21 tax year and so the first year's pay history that can be viewed is for the 2019-20 tax year. Pay history for later years will be recorded at the end of each tax year. A new option called Keep ... Tax Year History on the Set Options form in Payroll controls the number of years of tax year history that are saved, up to a maximum of 20 years.

The NI Code Values view displays all the employee's NI codes in a tax year alongside the pay period when they changed. This view is useful if the employee has more than one NI code during a tax year.

The existing History view has been renamed to Pay Period History. This view still displays a period-by-period summary of the currently selected employee's payroll history.